For which share of Goodwill a partner is entitled at the time of his retirement?

At the time of retirement, a partner is entitled to his share of goodwill as per his profit share in the business. It is valued as per agreement among the partners and the retiring partner is compensated for his share of goodwill by the continuing partners in their gaining ratio.

Arjun, Bhim and Nakul are partners sharing profits & losses in the ratio of 14:5:6 respectively.

Bhim retires and surrenders his 5/25th share in favour of Arjun. The goodwill of the firm is valued at 2 years purchase of super profits based on average profits of last 3 years. The profits for the last 3 years are Rs 50,000, Rs 55,000 & Rs 60,000 respectively. The normal profits for the similar firm are Rs 30,000. Goodwill already appears in the books of the firm at Rs 75,000.

The profit for the first year after Bhim's retirement was Rs 1,00,000. Give the necessary Journal Entries to adjust Goodwill and distribute profits showing your workings.

Journal Entries

|

Date |

Particulars |

LF |

Debit ( Rs) |

Credit (Rs) |

|

|

Arjun’s capital a/c Dr Bhim’s capital a/c Dr Nakul’s capital a/c Dr To Goodwill a/c (being decrease in the value of goodwill adjusted to the partners capital in their old profit sharing ratio) |

|

14,000 5,000 6,000

1,00,000 |

25,000

76,000 24,000

|

|

Profit and loss appropriation a/c Dr To Arjun’s capital a/c To Nakul’s capital a/c (Being new profit shared between remaining partners in their new profit sharing ratio)

|

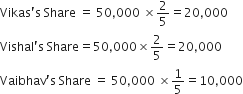

Old profit sharing ratio =14:5:6

Computation of Goodwill:

Average profit =(50000+55000+60000)/3=55000/-

Normal profit = 30000

Super profit =25000

Good will = super profit *2 years purchase= 25000*2=50000/-

Good will already in the book= 75000

Difference in present and book value of goodwill to be adjusted=75000-50000=25000

Good will to be debited in old profit sharing ratio 14:5:6

Arjun 25000*14/25=14000

Bhim 25000* 5/25=5000

Nakul 25000*6/25=6000

Computation of new profit sharing ratio:

Arjun’s new share =14/25+5/25 =19/25

Nakuls new share= 6/25

New profit sharing ratio= 19:6

Appropriation of new profit

Arjun: (100000*19)/25=76,000

Nakul: (100000*6)/25=24,000

M, N and O were partners in a firm sharing profits and losses equally. Their Balance Sheet on 31-12-2009 was as follows:

|

Liabilities |

Amount(Rs) |

Assets |

Amount(Rs) |

|

Capital: M 70,000 N 70,000 O 70,000

General Reserve Creditors |

2,10,000

30,000 20,000 |

Plant and Machinery Stock Sundry Debtors Cash at Bank Cash in Hand |

60,000 30,000 95,000 40,000 35,000 |

|

|

2,60,000 |

|

2,60,000 |

N died on 14th March, 2010. According to the Partnership Deed, executors of the deceased partner are entitled to:

(i) Balance of partner's capital account.

(ii) Interest on Capital @ 5% p.a.

(iii) Share of goodwill calculated on the basis of twice the average of past three year's profits and

(iv) Share of profits from the closure of the last accounting year till the date of death on the basis of twice the average of three completed year's profits before death.

Profits for 2007, 2008 and 2009 were Rs. 80,000, Rs. 90,000, Rs. 1,00,000 respectively. Show the working for deceased partner's share of goodwill and profits till the date of his death. Pass the necessary journal entries and prepare N's Capital Account to be rendered to his executors.

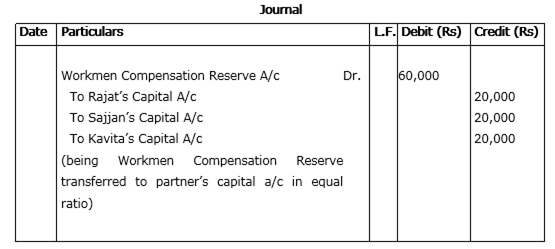

Journal

|

Date |

Particulars |

LF |

Dr (Rs.) |

Cr (Rs.) |

|

2010 14th March

|

General Reserve A/c Dr

To N’s Capital A/c

(Being transfer of N’s share of general reserve to his capital A/c)

|

|

10000

30000

30000

|

10000

700

60000

12000

152700 |

|

Interest on Capital A/c Dr

To N’s Capital A/c

(Being Interest 5% pa credited to N’s Capital A/c upto 14/3/2010)

|

||||

|

M’s Capital A/c Dr

O’s Capital A/c Dr

To N’s Capital A/c

(Being the share of Goodwill Adjusted)X |

||||

|

Profit and Loss Suspense A/c Dr

To N’s Capital A/c

(Being the transfer of N’s Share of Profit to his capital A/c upto the date of his death) |

||||

|

N’s Capital A/c Dr

To N’s Executor A/c

(Being the transfer of amount due to N’s = 1×5 executor a/c) |

N’s Capital A/c

|

Particulars |

Amount |

Particulars |

Amount |

|

To N’s Executor’s a/c |

152700 |

By Balance b/d

By General reserve a/c

By Interest on capital a/c (70,000 x 5 /100 x 73 /365)

By M’s Capital a/c

By O’s Capital a/c

By Profit & Loss Suspense A/c (90000 x 2x73/365x1/3) |

70000

10000

700

30000

30000

12000

|

|

152700 |

152700 |

Working Note

Calculation of Goodwill = Average Profit x No. of year of Purchase = 9000 x 2 = Rs. 180000

Average Profit = Total Profit / No. Of year = 270000 / 3 = 90000

N’s Share in Good Will = 180000 x1/3 = 60000.

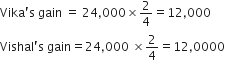

Give the journal entry to distribute Workman Compensation Reserve of Rs. 60,000 at the time of retirement of Sajjan, when there is not claim against it. The firm has three partners Rajat, Sajjan and Kavita.

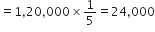

Vikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2:2:1. The firm closes its books 31st March every year. On 31-12-2015 Vaibhav died. On that date his Capital account showed a credit balance of ₹ 3,80,000 and Goodwill of the firm was valued at ₹ 1,20,000. There was a debit balance of ₹ 50,000 in the profit and loss account. Vaibhav's share of profit in the year of his death was to be calculated on the basis of the average profit of last five years. The average profit of last five years was ₹ 75,000. Pass necessary journal entries in the books of the firm on Vaibhav's death.