Kumar, Gupta and Kavita were partners in a firm sharing profits and losses equally. The firm was engaged in the storage and distribution of canned juice and its godowns were located at three different places in the city. Each godown was being managed individually by Kumar, Gupta and Kavita. Because of increase in business activities at the godown managed by Gupta, he had devote more time. Gupta demanded that his share in the profits of the firm be increased, to which Kumar and Kavita agreed. The new profit sharing ratio was agreed to be 1: 2: 1. For this purpose the goodwill of the firm was valued at two years purchase of the average profits of last five years. The profits of the last five years were as follows:

| Year | Profit (Rs) |

| I | 4,00,000 |

| II | 4,80,000 |

| III | 7,33,000 |

| IV | 33,000 |

| V | 2,20,000 |

You are required to:

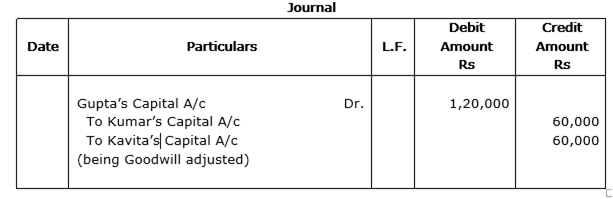

(i) Calculate the goodwill of the firm.

(ii) Pass necessary Journal Entry for the treatment of goodwill on change in profit sharing ratio of Kumar, Gupta and Kavita,

Working Notes:

Calculation of Goodwill of the firm:

Average Profit = (4,00,000+4,80,000+7,33,000+2,20,000-33,000)/5 = 3,60,000

Good will on the basis of 2 years purchase = 3,60,000*2 = 7,20,000.

Calculation of Gaining Ratio

Old Ratio = 1: 1: 1

New Ratio = 1: 2: 1

Gaining Ratio = New Ratio – Old Ratio

Kumar’s: 1/4 – 1/3 = (3-4)/120=01/12 (sacrifice)

Gupta’s: 2/4-1/3 = (6-4)/12 = 2/12 (Gain)

Kavita’s = ¼ - 1/3 = (3-4)/12 = 1/12 (Sacrifice)

Amount of goodwill to be adjusted = 7,20,000*1/12 = 60,000.

A, B, C and D were partners in a firm sharing profits in the ratio of 4:3:2:1. On 1-1-2015 they admitted E as a new partner for 1:10 share in the profits. E brought Rs 10,000 for his share of goodwill premium which was correctly recorded in the books by the accountant. The accountant showed goodwill at Rs 1,00,000 in the books. Was the accountant correct in doing so? Give reason in support of your answer.

According to AS 26, good will can be shown in books of accounts only when it is purchased. Otherwise, it should be immediately distributed among the old partners in their sacrificing ratio. Hereby showing it in the books of accounts, accountant has violated the law and made wrong accounting entry and hence he cannot be supported.

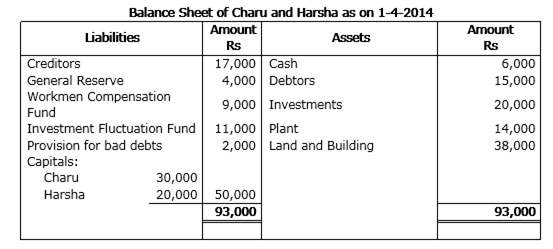

Charu and Harsha were partners in a firm sharing profits in the ratio of 3: 2. On 1-4-2014 their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms:

(a) Vaishali will bring Rs 20,000 for her capital and Rs 4,000 for her share of goodwill premium.

(b) All debtors were considered good.

(c) The market value of investments was Rs 15,000.

(d) There was a liability of Rs 6,000 for workmen compensation.

(e) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening current accounts.

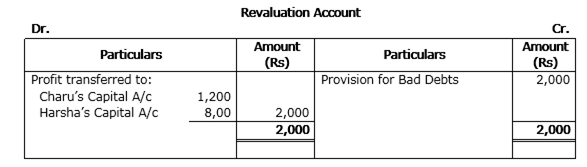

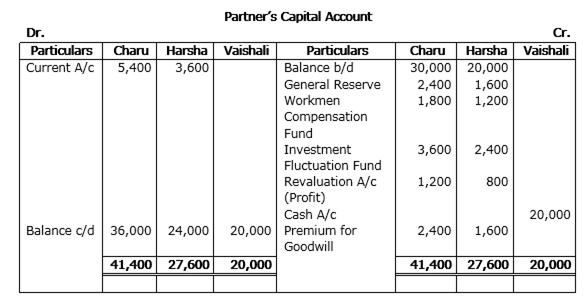

Prepare Revaluation Account and Partners' Capital Accounts.

Working Notes:

Calculation of new profit sharing ratio:

Old profit sharing ratio = 3:2

Vaishali is admitted for 1/4th share.

Hence profit share available to old partners are 1-1/4=3/4

Charu’s new profit share= 3/5*3/4=9/20

Harsha’s new profit share = 2/5*3/4=6/20

Vaishali’s =1/4=5/20

Hence new profit sharing ratio= 9:6:5

Calculation of sacrificing ratio:

Old Ratio= 3:2

New ratio=9:6:5

Hence sacrificing ratio= old ratio – new ratio

Charu’s =3/5-9/20=3/20

Harsha’s =2/5-6/20=2/20

Sacrificing ratio= 3:2

Distribution of goodwill:

Goodwill brought in =Rs 4,000

Charu’s share =4,000*3/5=2,400 Rs

Harsha’s share = 4000*2/5=1600 Rs

Adjustment of Capital:

Total capital of the firm = Capitalising Vaishali’s capital

=20,000*4/1 = Rs 80,000

New profit sharing Ratio = 9:6:5

Charu’s new capital =80000*9/20=36,000 Rs

Harsha’s new capital = 80,000*6/20= 24,000 Rs

Vaishali’s new capital = 20,000 Rs

What is meant by 'Reconstitution of a Partnership Firm'?

In a partnership firm, any change in the existing agreement between the partners amounts to its reconstitution. It leads to the end of the existing agreement and a new agreement comes into being with a changed relationship among the members of the partnership firm.

On 1-4-2010 Sahil and Charu entered into partnership for sharing profits in the ratio of 4: 3. They admitted Tanu as a new partner on 1-4-2012 for 1/5th share which she acquired equally from Sahil and Charu. Sahil, Charu and Tanu earned profits at a higher rate than the normal rate of return for the year ended 31-3-2013. Therefore, they decided to expand their business. To meet the requirements of additional capital they admitted Puneet as a new partner on 1-4-2013 for 1/7th share in profits which he acquired from Sahil and Charu in 7: 3 ratio.

Calculate:

(i) New profit sharing ratio of Sahil, Charu and Tanu for the year 2012-13.

(ii) New profit sharing ratio of Sahil, Charu, Tanu and Puneet on Puneet's admission.

Calculation of New Profit Sharing Ratio of Sahil, Charu and Tanu for the year 2012-13

Old Ratio of Sahil and Charu = 4:3

Tanu admitted for 1/5th share, acquired by her equally from Sahil and Charu

Calculation of sacrificing ratio:

Sahil = 1/5 * ½ = 1/10

Charu = 1/5 * ½ = 1/10

New Profit Share = Old Share – Sacrificing Share

Sahil: 4/7 – 1/10 = (40-7)/70 =33/70

Charu: 3/7 – 1/10 = (30-7)/70 = 23/70

And Tanu: 1/5 or 14/70

Therefore, New Profit Sharing Ratio of Sahil, Charu and Tanu = 33: 23: 14

Calculation of New Profit Sharing Ratio of Sahil, Charu, Tanu and Puneet

Old Ratio of Sahil, Charu and Tanu = 33: 23: 14

Puneet admitted for 1/7th share, acquired from Sahil and Charu in the ratio of 7: 3

Calculation of sacrificing ratio:

Sahil = 1/7 * 7/10 = 7/70

Charu = 1/7 * 3/10 = 3/70

New Profit Share = Old Share – Sacrificing Share

Sahil: 33/70 – 7/70 = 26/70

Charu: 23/70 – 3/70 = 20/70

Tanu: 14/70

Puneet = 1/7 or 10/70

Therefore, New Profit Sharing Ratio of Sahil, Charu, Tanu and Puneet = 26: 20: 14: 10