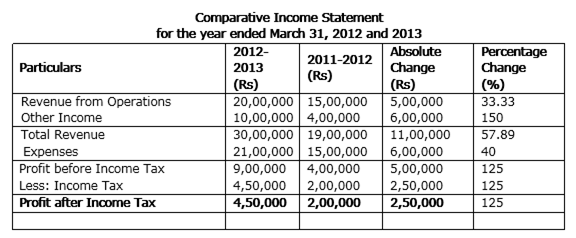

From the following 'Statement of Profit & Loss' for the year ended 31st March, 2013, prepare a 'Comparative Statement of Profit & Loss' of Good Service Ltd.

|

Particulars |

Note No. |

2012-2013 |

2011-2012 |

|

Revenue from operations |

|

20,00,000 |

15,00,000 |

Rate of income tax was 50%.

State any one limitation of 'Analysis of Financial Statements'.

Analysis of Financial Statements suffers from certain limitations and they are:

a) It is only a study of interim report.

b) It ignores non-monetary factors.

From the following Balance Sheets of Sonam Ltd as on 31-3-2012 and 31-3-2011.

Prepare a Cash Flow Statements:

|

Liabilities |

31-3-2011 Rs |

31-3-2011 Rs |

Assets |

31-3-2011 Rs |

31-3-2011 Rs |

|

Equity Shares Capital Profit and Loss Account Bank Loan Proposed Dividend Provision for tax Creditors |

1,00,000

25,000

50,000 20,000

10,000 15,000

|

1,50,000

50,000

25,000 15,000

17,500 11,250 |

Patents Building Investment Debtors Stock Cash

|

12,500 1,50,000 - 50,000 2,500 5,000 |

11,250 1,50,000 18,750 3,750 21,250 |

|

|

|

||||

|

2,20,000 |

2,68,750 |

|

2,20,000 |

2,68,750 |

|

|

|

|

|

|

Additional Information:

During the year a Building having book value Rs 50,000 was sold at a loss of Rs 2,000 and depreciation charged on Building was Rs 4,000.

Cash Flow Statement Activities:

|

|

Particulars |

Amount Rs |

Amount Rs |

|||

|

|

a)Cash Flow from Operating Activities |

|

|

|||

|

|

Profit during the year 25,000 |

|

|

|||

|

|

Proposed Dividend 15,000 |

|

|

|||

|

|

Provision for Taxation 17,500 |

|

|

|||

|

|

Profit before Taxation |

57,500 |

|

|||

|

|

Add: non cash and non-operating expenses |

|

|

|||

|

|

|

Depreciation |

4,000 |

|

||

|

|

|

Loss on Sale of Assets |

2,000 |

|

||

|

|

|

Patents Written-off |

1,250 |

|

||

|

|

Operating Profit before Working Capital Changes |

64,750 |

|

|||

|

|

|

Less: |

Increase in current assets and decrease in current liabilities Increase in Debtors |

(13,750) |

|

|

|

|

|

Increase in Stock |

(1,250) |

|

||

|

|

|

Decrease in Creditors |

(3,750) |

|

||

|

|

Profit from operation before Tax paid |

46,000 |

|

|||

|

|

|

Less: |

Tax paid |

10,000 |

|

|

|

|

Net Cash flow from Operating Activities |

36,000 |

36,000 |

|||

|

|

|

|

|

|

|

|

|

|

(B) Cash Flow from Investing Activities |

|

|

|||

|

|

|

Proceeds from Sale of Building |

48,000 |

|

||

|

|

|

Less: |

Purchase of Building |

(54,000) |

|

|

|

|

|

Less: |

Purchase of Investment |

(18,750) |

|

|

|

|

Net Cash flow from Investing Activities |

(24,750) |

(24,750) |

|||

|

|

|

|

|

|

|

|

|

|

(C) Cash Flow from Financing Activities |

|

|

|||

|

|

Proceeds from Issue of Share |

50,000 |

|

|||

|

|

|

Less: |

Repayment of loan |

(25,000) |

|

|

|

|

|

Less: |

Dividend Paid |

(20,000) |

|

|

|

|

Net Cash flow from Financing Activities |

5,000 |

5,000 |

|||

|

|

Net Increase in Cash and Cash Equivalents(A+B+C) |

|

16,250 |

|||

|

|

|

Add: |

Cash at the beginning |

|

5,000 |

|

|

|

Cash at the end |

|

21,250 |

|||

|

|

|

|

|

|

||

Working Notes:

|

Building Account |

||||||||

|

Dr. |

|

|

|

|

Cr. |

|||

|

Date |

Particulars |

Amount Rs |

Date |

Particulars |

Amount Rs |

|||

|

|

Balance b/d |

1,50,000 |

|

Depreciations |

4,000 |

|||

|

|

|

|

|

Sale |

48,000 |

|||

|

|

|

|

|

Profit and loss a/c |

2,000 |

|||

|

|

|

|

|

|

|

|||

|

|

Bank A/c (Purchase-Balancing figure) |

54,000 |

By balance c/d |

1,50,000 |

||||

|

|

|

2,04,000 |

|

|

2,04,000 | |||

State any one objective of Financial Statement Analysis.

The most important objective of Financial Statement Analysis is to diagnose the information contained in financial statements so as to judge the profitability and financial soundness of the business. It provides better and easy understanding of the changes in the financial data over a period of time.

State the significance of Analysis of Financial Statements to the Lenders.

Analysis of financial statements helps the lenders in assessing the long-term solvency of the business. It also helps them in evaluating the relative financial status of a firm in comparison to other competitive firms.