Name the account which is opened to credit the share of profit of the deceased partner, till the time of his death to his Capital account.

The account opened to credit the share of profit of deceased partner, till the time of his death to his capital account is Profit and Loss Suspense Account.

On the retirement of Hari from the firm of 'Hari, Ram and Sharma' the balance-sheet showed a debit balance of Rs 12,000 in the profit and loss account. For calculating the amount payable to Hari this balance will be transferred

(a) to the credit of the capital accounts of Hari, Ram and Sharma equally

(b) to the debit of the capital accounts of Hari, Ram and Sharma equally

(c) to the debit of the capital accounts of Ram and Sharma equally

(d) to the credit of the capital accounts of Ram and Sharma equally

Answer is option b. Since at the time of retirement of a partner, the profit and loss account balance is transferred to the old partner’s capital account in their old profit sharing ratio, the debit balance of profit and loss account is to be transferred to the debit of the capital accounts of Hari, Ram and Sharma equally.

Kumar, Verma and Naresh were partners in a firm sharing profit & loss in the ratio of 3: 2: 2. On 23rd January, 2015 Verma died. Verma's share of profit till the date of his death was calculated at Rs 2,350.

Pass necessary journal entry for the same in the books of the firm.

| Date | Particulars | L.F. | Debit(Rs.) | Credit (Rs.) |

Profit and Loss Suspense A/C Dr. To Verma's Capital A/C (Verma's share of Profit transferred to his Capital Account) |

2350 | 2350 |

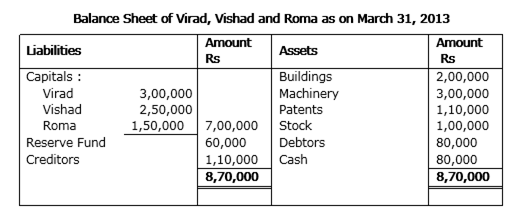

Virad, Vishad and Roma were partners in a firm sharing profits in the ratio of 5:3:2 respectively. On March 31, 2013, their Balance Sheet was as under:

Virad died on October 1, 2013. It was agreed between his executors and the remaining partner's that:

(a) Goodwill of the firm be valued at 2 1/2 years purchase of average profits for the last three years. The average profits were Rs 1,50,000.

(b) Interest on capital be provided at 10% p.a.

(c) Profit for the year 2013-14 be taken as having accrued at the same rate as that of the previous year which was Rs 1,50,000. Prepare Virad's Capital Account to be presented to his Executors as on October 1, 2013.

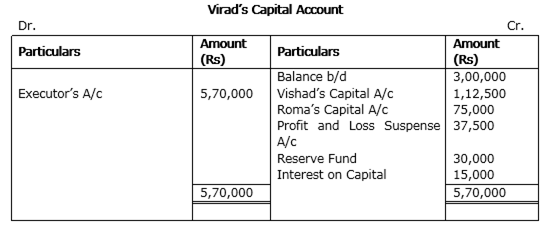

Calculation of Gaining Ratio of Vishad and Roma:

Old Ratio = 5: 3: 2

New ratio = 3:2

Calculation of gain ratio:

Vishad: 3/5- 3/10 = 3/10

Roma: 2/5 – 2/10 = 2/10

Gaining ratio = 3:2

Calculation of Virat’s share of goodwill:

Average Profit = Rs 1,50,000

Goodwill at 2 ½ years purchase = 1,50,000 x 2 ½ = Rs 3,75,000

Virad’s share of goodwill = 3,75,000 x 5/10 = R 1,87,500

Good will to be transferred to Vishad’s capital a/c = 1,87,500 * 3/5 = Rs 1,12,500

Good will to be transferred to Roma’s capital a/c = 1,87,500 * 2/5 = 75,000

Share of Profit payable to Virad up to the 1/10/2013:

= 1,50,000 x 5/10 x 6/12 = Rs 37,500

Interest on Virad’s Capital:

= 3,00,000 * 10% * 6/12

Virad’s share of Reserve fund:

= 60,000 * 5/10 = 30,000

Why heirs of a retiring/deceased partner are entitled to a share of goodwill of the firm?