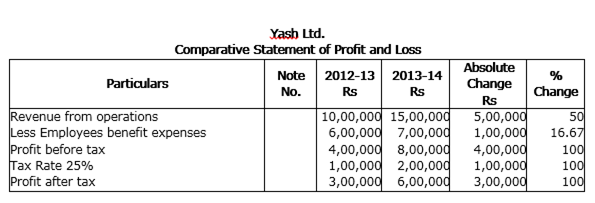

The motto of Yash Ltd., an advertising company is 'Service with Dignity'. Its management and work force is hard-working, honest and motivated. The net profit of the company doubled during the year ended 31-3-2014. Encouraged by its performance company decided to give one-month extra salary to all its employees. Following is the Comparative Statement of Profit and Loss of the company for the years ended 31st March 2013 and 2014.¬Ý

(a) Calculate Net Profit Ratio for the years ending 31st March, 2013 and 2014.

(b) Identify any two values which Yash Ltd. is trying to propagate.

31/ March/ 2013:

Net Profit Ratio = ( Net profit after tax/ revenue from operations)*100

= (3,00,000/10,00,000)*100 = 30%

31/ March/2014:

Net Profit Ratio = (Net Profit after tax/ Revenue from operations)*100

= (6,00,000/ 15,00,000)* 100 = 40%

Values of Yash Ltd:

(i) Focus on consideration and welfare of employees.

(ii) Motivating and boosting the morale of employees form better performance.

From the following information related to Naveen Ltd. calculate¬Ý

Total Assets to Debt Ratio

Information: Fixed Assets Rs 75,00,000; Current Assets Rs 40,00,000; Current Liabilities Rs 27,00,000; 12% Debentures Rs 80,00,000 and Net Profit before Interest, Tax and Dividend Rs 14,50,000.

2) Total Assets to Debt to Ratio:

Total Assets to Debit Ratio = Total Assets/ Debts

Total Assets to Debt Ratio = Total Assets/ Debt

Total Assets = Fixed Assets + Current Assets

=75,00,000 + 40,00,000 = 1,15,00,000

Debt = 80,00,000

Total Assets to Debt Ratio = (1,15,00,000/80,00,000) = 1.44

From the following Balance Sheets of Vijaya Ltd. as on 31-3-2009 and 31-3-2010 prepare a Cash Flow Statement.

|

Liabilities |

31-3-2009 (Rs) |

31-3-2010 (Rs) |

Assets |

31-3-2009 (Rs) |

31-3-2010 (Rs) |

|

Share Capital General Reserve Profit & loss account Trade Creditors ¬Ý |

45,000 15,000 10,000 8,700 |

65,000 27,500 15,000 11,000 |

Fixed Assets Stock Debtors Cash Preliminary expense |

46,700 11,000 18,000 2,000 1,000 |

83,000 13,000 19,500 2,500 500 ¬Ý |

|

¬Ý |

78,700 |

1,18,500 |

¬Ý |

78,700 |

1,18,500 |

¬Ý

Additional Information:

(i) Depreciation on Fixed Assets for the year 2009-2010 was Rs. 14,700.

(ii) An interim dividend Rs. 7,000 has been paid to the shareholders during the year.

Cash Flow Statement

¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý (For the year ended 31st March 2010)

|

Particulars |

Rs |

Rs |

¬Ý | |

|

(A) Cash Flow from Operating Activities :‚Äì ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý ¬ÝNet Profit Before Tax ¬Ý Adjustment: Add 1. Depreciation on Fixed Assets ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý 2. written off Preliminary Expenses ¬Ý ¬Ý Operating Profit Before Changes in Working Capital ¬Ý Less : Increase in Current Assets ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý Stock ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý Debtors ¬Ý Add: Increase in Current Liabilities ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý Trade Creditors ¬Ý Cash Flow from Operating Activities :‚Äì ¬Ý (B). Cash Flow from Investing Activities: ¬Ý Purchase of Fixed Assets ¬Ý Net Cash Used in Investing Activities :‚Äì ¬Ý ¬Ý (C). Cash Flow from Financing Activities: ¬Ý

¬Ý Payment of Interim Dividend ¬Ý Cash Flow from Financing Activities: ¬Ý Net Increase in Cash & Cash Equivalent ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý Add: Opening Balance of Cash & Cash Equivalent ¬Ý ¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý¬Ý Closing Balance of Cash & Cash Equivalent |

¬Ý |

¬Ý |

¬Ý | |

|

¬Ý 24500 ¬Ý 14700 ¬Ý 500 ¬Ý |

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý (51000) ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý 13000 ¬Ý |

¬Ý | ||

|

¬Ý 39700 ¬Ý ¬Ý ¬Ý (2000) ¬Ý (1500) ¬Ý ¬Ý ¬Ý 2300 ¬Ý |

¬Ý | |||

|

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý (51000) ¬Ý ¬Ý ¬Ý |

¬Ý | |||

|

¬Ý ¬Ý 20000 ¬Ý (7000) |

¬Ý | |||

|

¬Ý ¬Ý ¬Ý ¬Ý |

¬Ý | |||

|

500 ¬Ý 2000 ¬Ý |

¬Ý | |||

|

¬Ý 2500 |

¬Ý |

|||

Working Note: Calculation of net profit before tax

|

¬Ý Net profit as per profit and loss account (15000-10000) Add transfer to general reserve Interim dividend paid during the year Net profit before tax |

¬Ý 5000 12500 7000 |

||||||||||||

|

24500 |

|||||||||||||

|

¬Ý Fixed asset account

¬Ý |

¬Ý |

||||||||||||

|

¬Ý |

¬Ý |

From the following information, calculate any two of the following ratios:

(a)¬ÝDebt-Equity Ratio

(b)¬ÝWorking Capital Turnover Ration and

(c)¬ÝReturn on Investment

Information:¬ÝEquity Share capital Rs 50,000, General Reserve Rs 5,000; Profit and Loss

Account after tax and interest Rs 15,000; 9% Debenture Rs 20,000; Creditors Rs 15,000; Land and Building Rs 65,000; Equipment Rs 15,000; Debtors Rs 14,500 and Cash Rs 5,500. Discount on issue of shares Rs 5,000

Sales for the year ended 31-3-2011 was Rs 1,50,000. Tax rate 50%.

i) Debt equity Ratio:

= long term debt/shareholders fund

long term debt =debentures¬Ý =20000

Shareholders fund = equity share capital + General reserve +P & L a/c- discount on issue of share

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý= 50,000+5000+15,000 - 5000=65,000

Debt equity ratio= 20000/65000=0.31:1

¬Ý

ii) Working Capital Turnover Ratio:

=(sales/ working capital)=150000/(current assets – current liabilities)

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý=150000/(14500+5500-15000)

¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý ¬Ý=150000/5000=30times

¬Ý

iii) Return on investment:

=Profit before interest and tax/ capital employed

Profit after interest and tax= 15000

Profit before tax= 15000*100/50=30000

Profit before interest and tax=30000+(9% of 20000)=30000+1800=31800

Capital employed=debt+equity=20000+65000=85000

Return on investment =31800/85000*100=37.41%

¬Ý

From the following information related to Naveen Ltd. calculate¬Ý

Return on Investment

Information: Fixed Assets Rs 75,00,000; Current Assets Rs 40,00,000; Current Liabilities Rs 27,00,000; 12% Debentures Rs 80,00,000 and Net Profit before Interest, Tax and Dividend Rs 14,50,000.

Return on Investment

= (Net profit before interest, tax and dividend/Capital employed)*100

Net profit before interest, Tax and Dividend = Rs 14,50,000

Capital employed = Fixed Assets + current assets- current liabilities

= 75,00,000 + 40,00,000 – 27,00,000= 88,00,000 Rs

Return on investment = (14,50,000/88,00,000)* 100= 16.48%