(i) Debt trap. Fiscal deficit, i.e., borrowing creates problems of not only

(a) repayment of loans but also of (b) payment of interest. As the government borrowing increases, its liability in future to repay loans along with interest thereon also increases. Payment of interest increases revenue expenditure leading to a higher revenue deficit. Increased revenue deficit may further lead to more borrowing and more interest payment. Ultimately government may be compelled to borrow to finance even interest payment leading to emergence of a vicious circle and debt trap.

(ii) Wasteful expenditure. High fiscal deficit generally leads to wasteful and unnecessary expenditure by the government. Therefore, fiscal deficit should be kept as low as possible.

(iii) Inflationary pressure. As government borrows mainly from RBI which meets this demand by printing of more currency-notes (called deficit financing), it results in circulation of more money. This may cause inflationary pressure in the economy.

(iv) Retards future growth. The entire amount of fiscal deficit, i.e., whole borrowed amount is not available for growth and development of economy because a part of it is used for interest payment. Only primary deficit (fiscal deficit - interest payment) is available for financing expenditure. In fact, borrowing is financial burden on future generation to pay loan and interest amount which retards growth of economy.

(v) Increases foreign dependence. Government also borrows from foreign countries. This increases dependence on foreign countries which often lead to economic and political interference.

Is fiscal deficit advantageous? It depends on its use. Fiscal deficit is advantageous to a country, if it creates new capital assets which increase productive capacity and generate future income stream. On the contrary it is deterimental for the economy if it is used merely to cover revenue deficit.

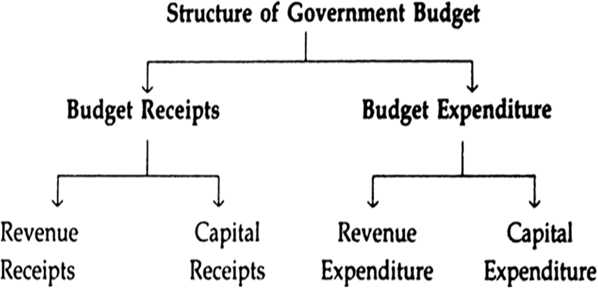

Components of the budget. The budget is divided into two parts — (i) Revenue Budget, and (ii) Capital Budget.

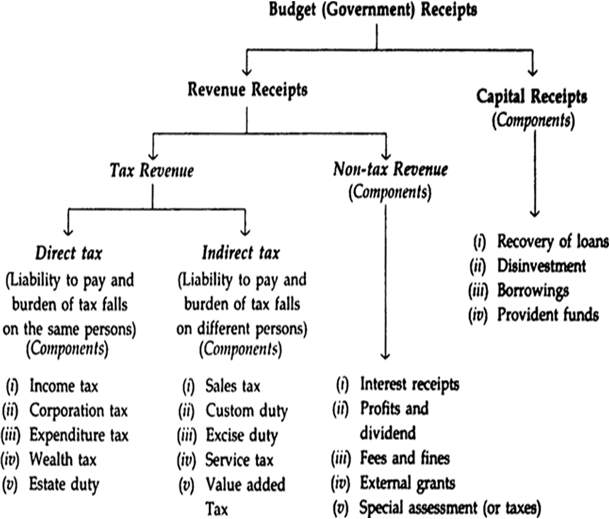

(i) The Revenue Budget comprises current revenue receipts and current expenditure met from such revenues. The revenue receipts include both tax revenue (like income tax, excise duty) and non-tax revenue (like interest receipts, profits). (ii) Capital Budget consists of capital receipts (like borrowing, disinvestment) and capital expenditure (creation of assests, investment) of the government. Capital receipts are receipts of the government which create liabilities or reduce assets. Capital expenditure is the expenditure of the government which either reduces liability or creates an asset. Thus, capital budget is an account of assets and liabilities of the government which takes into consideration changes in capital.

The structure (or components) of a government budget broadly consists of two parts — Budget Receipts and Budget Expenditure as shown in the following chart. Let us see their classification.

How is fiscal deficit met? When drastic cut in public expenditure and revenue expenditure fail to solve this problem, fiscal deficit is met by the following measures. Let it be noted that safe level of fiscal deficit is considered to be 5% of GDP.

(i) Borrowing from domestic sources. Fiscal deficit can be met by borrowing from domestic sources. Borrowing from public is considered better than deficit financing because it does not increase money supply which is regarded as main cause of rising prices. It also includes tapping of money deposits in Provident Fund, Small Saving Schemes.

(ii) Borrowing from external sources like world bank, foreign banks, IMF, etc.

(iii) Deficit financing (printing of extra currency-notes). Another measure to meet fiscal deficit is by borrowing from Reserve Bank of India. Government issues treasury bills which RBI buys in return for cash to the government. This cash is created by printing new currency-notes against government securities. Thus it is an easy way to raise funds but it carries with it adverse effects also. Its implication is that money supply increases in the economy creating inflationary trends and other ills that result from deficit financing. Therefore, deficit financing, if at all unavoidable, should be kept within safe limits.

Measures to reduce fiscal deficit. (a) Measures to reduce public expenditure are: (i) A drastic reduction in expenditure on major subsidies, (ii) Reduction in expenditure on LTC, bonus, leave encashment, etc. (iii) Austerity measures to curtail non-plan expenditure.

(b) Measures to increase revenue are: (i) Tax base should be broadened, (ii) Tax evasion should be effectively checked, (iii) More emphasis on direct tax to increase revenue, and

(iv) Sale of shares in public sector units.