Short Answer Type

Short Answer Type(a)From the following information, compute Debt-Equity Ratio:

| Long Term Borrowings | 2,00,000 |

| Long Term Provisions | 1,00,000 |

| Current Liabilities | 50,000 |

| Non-Current-Assets | 3,60,000 |

| Current - Assets | 90,000 |

(b) The current ratio of X. Ltd is 2:1. State with reason which of the following transaction could (i) increase; (ii) decrease or (iii) not change the ratio.

(1) Included in the trade payables was a bills payable of Rs 9,000 which was met on maturity.

(2) Company issued 1,00,000 equity shares of Rs 10 each to the Vendors of machinery purchased.

(a) Debt- Equity Ratio = Long term Debt/ Share holder’s fund or Debt/ Equity.

Debt = 200000 + 100000 (borrowings+ provisions) = Rs 3,00,000

Equity = Current Assets + Non Current Assets –debts - Current Liabilities= 90,000+3,60,000-3,00,000—50,000 = Rs 1,00,000

(b)

(1) A bill payable of Rs 9,000 was met on maturity:

a) Trade Payables will reduce by Rs 9,000 (liability reduced)

b) Cash will reduce by Rs 9,000 (asset reduced)

This simultaneous decrease in both current assets and current liabilities leads to increase in ratio.

(2) Issue of shares of Rs 10,00,000 to vendor of Machinery will affect the following:

Neither Current Assets nor Current Liabilities are changing hence no change in the ratio.

Long Answer Type

Long Answer TypeNaveen, Seerat and Hina were partners in a firm manufacturing blankets. They were sharing profits in the ratio of 5 : 3 : 2. Their capitals on 1st April, 2012 were Rs 2,00,000: Rs 3,00,000 and Rs 6,00,000 respectively. After the floods in Uttaranchal, all partners decided to help the flood victims personally. For this Naveen withdrew Rs 10,000 from the firm on 1st September, 2012. Seerat, instead of withdrawing cash from the firm took blankets amounting to Rs 12,000 from the firm and distributed to the flood victims. On the other hand, Hina withdrew Rs 2,00,000 from her capital on 1st January, 2013 and set up a centre to provide medical facilities in the flood affected area. The partnership deed provides for charging interest on drawings @ 6% p.a. After the Final Accounts were prepared, it was discovered that interest on drawings had not been charged. Give the necessary adjusting journal entry and show the working notes clearly. Also state any two values that the partners wanted to communicate to the society.

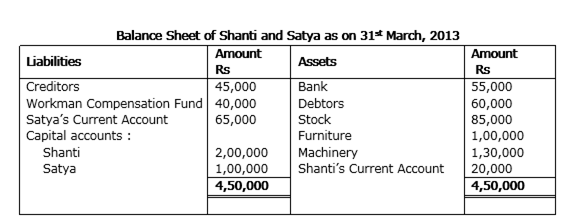

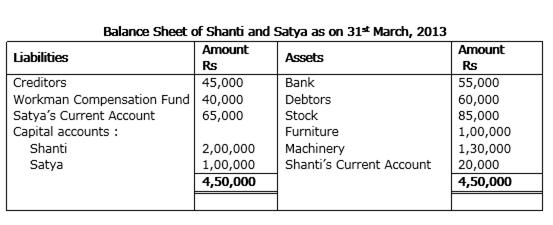

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

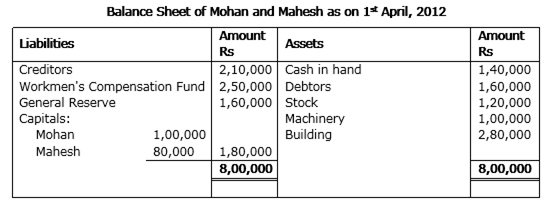

Mohan and Mahesh were partners in a firm sharing profits in the ratio of 3:2. On 1st April, 2012 they admitted Nusrat as a partner in the firm. The Balance Sheet of Mohan and Mahesh on that date was as under:

It was agreed that:

(i) The value of Building and Stock be appreciated to Rs 3,80,000 and Rs 1,60,000 respectively.

(ii) The liabilities of workmen's compensation fund was determined at Rs 2,30,000.

(iii) Nusrat brought in her share of goodwill Rs 1,00,000 in cash.

(iv) Nusrat was to bring further cash as would make her capital equal to 20% of the combined capital of Mohan and Mahesh after above revaluation and adjustments are carried out.

(v) The future profit sharing ratio will be Mohan 2 / 5, Mahesh 2/5, Nusrat 1/5.

Prepare Revaluation Account, Partner's Capital Accounts and Balance Sheet of the new firm. Also show clearly the calculation of Capital brought by Nusrat.

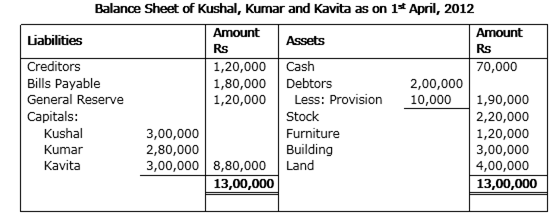

Kushal Kumar and Kavita were partners in a firm sharing profits in the ratio of 3:1:1. On 1st April, 2012 their Balance Sheet was as follows:

On the above date Kavita retired and the following was agreed:

(i) Goodwill of the firm was valued at Rs 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by Rs 1,00,000.

(iii) Value of furniture was to be reduced by Rs 20,000.

(iv) Bad debts reserve is to be increased to Rs 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her Loan Account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their Capital Accounts will be adjusted through Current Accounts.

Prepare Revaluation Account, Partner's Capital Accounts and Balance Sheet of Kushal and Kumar after Kavita's retirement.

XYZ Ltd. invited applications for 40,000 equity shares of Rs 100 each at a discount of 6%. The amount was payable as follows:

On Application and Allotment Rs 90 per share. On First and Final call the balance amount. Application for 60,000 shares were received. Applications for 10,000 shares were rejected and shares were allotted on pro-rata basis to remaining applicants. Excess application money received on application and allotment was adjusted towards sums due on first and final call. The calls were made. A shareholder, who applied for 50 share, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were re-issued at Rs 97 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of XYZ Ltd.

AB Ltd. invited applications for issuing 75,000 equity shares of Rs 100 each at a premium of Rs 30 per share. The amount way payable as follows:

On Application and Allotment Rs 85 per share (including premium)On First and Final call the balance Amount Applications for 1,27,500 shares were received. Applications for 27,500 shares were rejected and share were allotted on pro-rata basis to the remaining applicants. Excess money received on application and allotment was adjusted towards sums due to first and final call. The calls were made. A shareholder, who applied for 1,000 shares, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were reissued at Rs 150 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of AB Ltd.

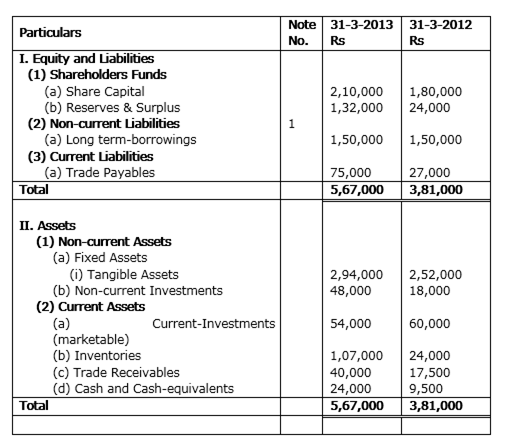

Prepare a Cash Flow Statement on the basis of the information given in the Balance Sheets of Liva Ltd. as at 31-3-2013 and 31-3-2012:

Notes to Accounts:

Note 1

|

Particulars |

2013 |

2012 |

|

Reserves and Surplus |

1,32,000 |

24,000 |