Long Answer Type

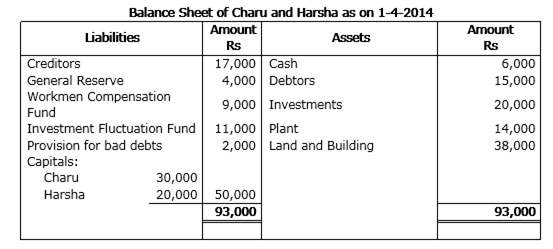

Long Answer TypeCharu and Harsha were partners in a firm sharing profits in the ratio of 3: 2. On 1-4-2014 their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms:

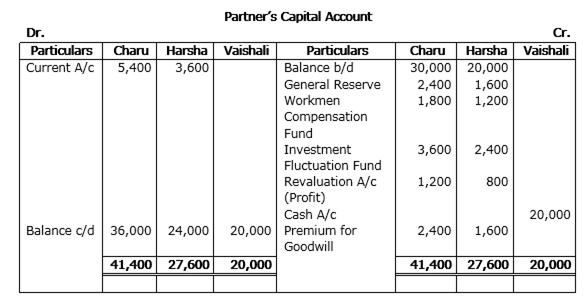

(a) Vaishali will bring Rs 20,000 for her capital and Rs 4,000 for her share of goodwill premium.

(b) All debtors were considered good.

(c) The market value of investments was Rs 15,000.

(d) There was a liability of Rs 6,000 for workmen compensation.

(e) Capital accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening current accounts.

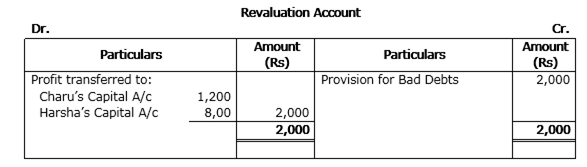

Prepare Revaluation Account and Partners' Capital Accounts.

Working Notes:

Calculation of new profit sharing ratio:

Old profit sharing ratio = 3:2

Vaishali is admitted for 1/4th share.

Hence profit share available to old partners are 1-1/4=3/4

Charu’s new profit share= 3/5*3/4=9/20

Harsha’s new profit share = 2/5*3/4=6/20

Vaishali’s =1/4=5/20

Hence new profit sharing ratio= 9:6:5

Calculation of sacrificing ratio:

Old Ratio= 3:2

New ratio=9:6:5

Hence sacrificing ratio= old ratio – new ratio

Charu’s =3/5-9/20=3/20

Harsha’s =2/5-6/20=2/20

Sacrificing ratio= 3:2

Distribution of goodwill:

Goodwill brought in =Rs 4,000

Charu’s share =4,000*3/5=2,400 Rs

Harsha’s share = 4000*2/5=1600 Rs

Adjustment of Capital:

Total capital of the firm = Capitalising Vaishali’s capital

=20,000*4/1 = Rs 80,000

New profit sharing Ratio = 9:6:5

Charu’s new capital =80000*9/20=36,000 Rs

Harsha’s new capital = 80,000*6/20= 24,000 Rs

Vaishali’s new capital = 20,000 Rs

Bharat Ltd. had an authorized capital of Rs 20,00,000 divided into 2,00,000 equity shares of Rs 10 each. The company issued 1,00,000 shares and the dividend paid per share was Rs 2 for the year ended 31-3-2008. The management of the company decided to export its products to the neighbouring countries Nepal, Bhutan, Sri Lanka and Bangladesh. To meet the requirement of additional funds the financial manager of the company put up the following three alternatives before its Board of Directors:

(i) Issue 54,000 equity shares

(ii) Obtain a loan from Import and Export Bank of India. The loan was available at 12% per annum interest.

(iii) To issue 9% Debentures at a discount of 10%.

After comparing the available alternatives the company decided on 1-4-2008 to issue 6,000 9% debentures of Rs 100 each at a discount of 10%. These debentures were redeemable in four installments starting from the end of third year. The amount of debentures to be redeemed at the end of third, fourth, fifth and sixth year was as follows:

| Year | Profit Rs |

| III | 1,00,000 |

| IV | 1,00,000 |

| V | 2,00,000 |

| VI | 2,00,000 |

Prepare 9% Debentures Account for the year 2008-09 to 2013-14.

Alfa Ltd. invited applications for issuing 75,000 equity shares of Rs 10 each. The amount was payable as follows:

On application and allotment Rs 4 per share. On first call Rs 3 per share. On second and final call balance.

Application for 1,00,000 shares were received. Shares were allotted to all the applicants on pro-rata basis and excess money received with applications was transferred towards sums due on first call. Vibha who was allotted 750 shares failed to pay the first call. Her shares were immediately forfeited. Afterwards, the second call was made. The amount due on second call was also received except on 1000 shares, applied by Monika. Her shares were also forfeited. All the forfeited shares were re-issued to Mohit for Rs 9,000 as fully paid up.

Pass necessary journal entries in the books of Alfa Ltd. for the above transactions.

Jeevan Dhara Ltd. invited applications for issuing 1,20,000 equity shares of Rs 10 each at a premium of Rs 2 per share. The amount was payable as follows:

On application Rs 2 per share.

On allotment Rs 5 per share (including premium)

On first and final call balance.

Applications for 1,50,000 share were received. Shares were allotted to all the applicants on pro-rata basis. Excess money received on applications was adjusted towards sums due on allotment. All calls were made. Manu who has applied for 3,000 share failed to pay the amount due on allotment and first and final call. Madhur who was allotted 2,400 shares failed to pay the first and final call. Shares of both Manu and Madhur were forfeited. The forfeited shares were re-issued at Rs 9 per share as fully paid up.

Pass necessary journal entries for the above transactions in the books of Jeevan Dhara Ltd.