Long Answer Type

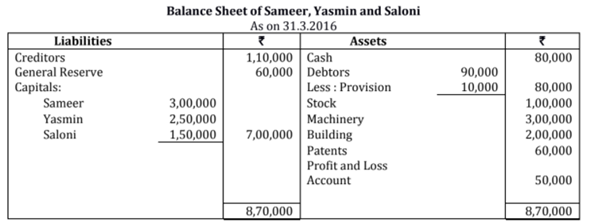

Long Answer TypeSameer,Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4:3:3. On 31.3.2016, their Balance Sheet was as follows:

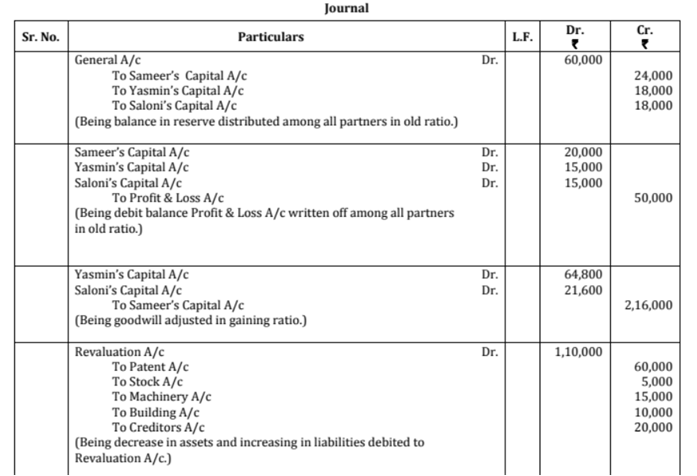

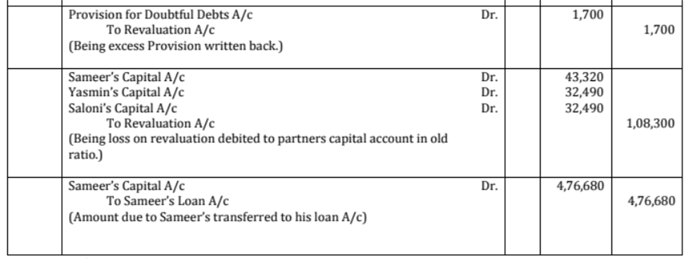

On the above date, Sameer retired and it was agreed that:

(i) Debtors of 4,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) An unrecorded creditor of 20,000 will be recorded.

(iii) Patents will be completely written off and 5% depreciation will be charged on stock, machinery and building.

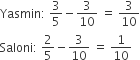

(iv) Yasmin and Saloni will share future profits in the ratio of 3:2

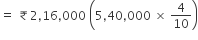

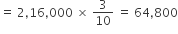

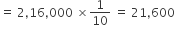

(v) Goodwill of the firm on Sameer's retirement was valued at ₹5,40,000.

Pass necessary journal entries for the above transactions in the books of the firm on Sameer’s retirement.

On 1.4.2015, KVK Ltd. issued 15,000, 9% debentures of ₹ 100 each at a discount of 7%, redeemable at a premium of 10% after 10 years. The company closes its books on 31st March every year. Interest on 9%debentures is payable on 30th September and 31st March every year. The rate of tax deducted at source is 10%.

Pass necessary journal entries for the issue of 9% debentures and debenture interest for the year ended 31.3.2016.

VXN Ltd invited application for issuing 50,000 equity shares of ₹ 10 each as a premium of 8 per share. The amount was payable as follows:

On Application: ₹4 per share (including ₹ 3 premiums)

On Allotment: ₹6 per share (including ₹ 3 premiums)

On First Call: ₹5 per share (including ₹ 1 premium)

On second and final call: Balance Amount

The issue was fully subscribed Gopal a shareholder holding 200 shares did not pay the allotment money and Madhav, a holder of 400 shares paid his entire share money along with the allotment money. Gopal's Shares were immediately forfeited after allotment, Afterwards, the first call was made Krishna, a holder of 100 shares, failed to pay the first call money and Giridhar, a holder of 300 shares, paid the second call money also along with the first call. Krishna's shares were forfeited immediately after the first call. Second and final call was made afterwards and was duly received. All the forfeited shares were reissued at ₹ 9 per share fully paid up.

Pass necessary journal entries for the above transaction in the books of the company.

JJK Ltd invited application or issuing 150,000 equity shares of 10 each at par. The amount was payable as follows:

On Application: ₹ 2 per share

On Allotment : ₹ 4 per share

On First and Final Call: Balance Amount

The issue was oversubscribed three times. Applications for 30% shares were rejected and money refunded. Allotment was made to the remaining applicants as follows:

Category No of Shares Applied No of shares Allotted

I 80,000 40,000

II 25,000 10,000

Excess money paid by the applicants who were allotted shares was adjusted towards the sums due on allotment.

Deepak, a shareholder belonging the Category I, who had applied for 1,000 shares, failed to pay the allotment money. Raju, a shareholder holding 100 shares, also failed to pay the allotment money. Raju belonged to category II. Shares of both Deepak and Raju were forfeited immediately after allotment. Afterwards, first and final call was made and was duly received. The forfeited shares of Deepak and Raju were reissued at 11 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of the company.

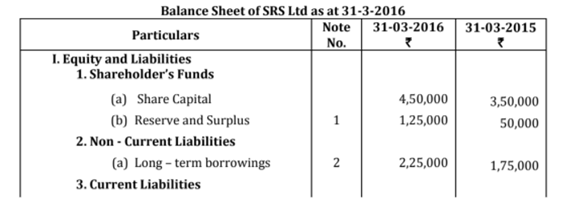

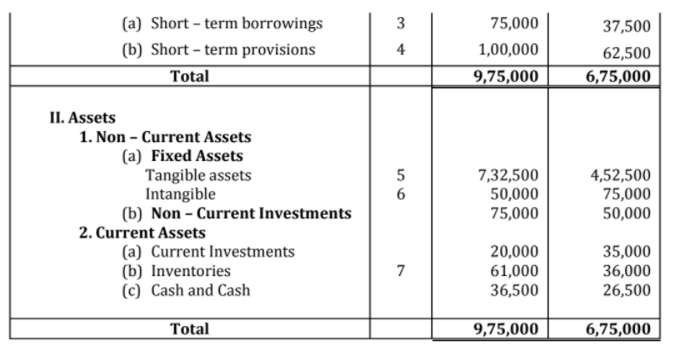

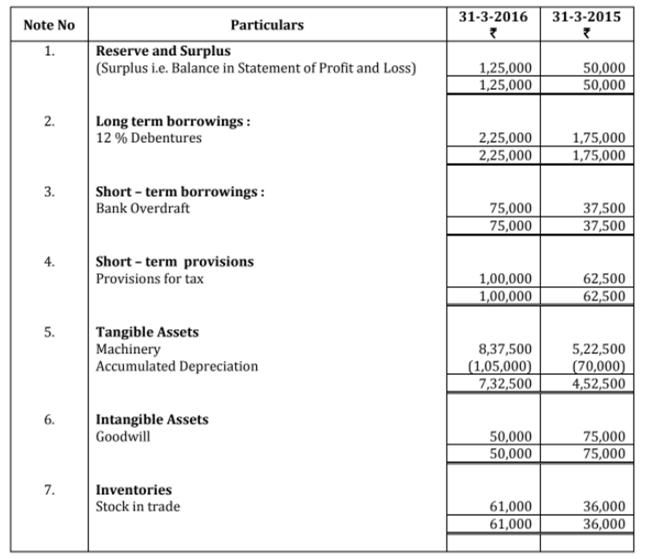

From the following Balance Sheet as SRS Ltd and the additional information as in 31.3.2016, prepare a Cash Flow Statements:

Additional Information:

(i) ₹50,000 12% debentures were issued on 31.3.2016

(ii) During the year a piece of machinery costing ₹40,000 on which accumulated depreciation was ₹20,000 was sold at loss of ₹5,000.