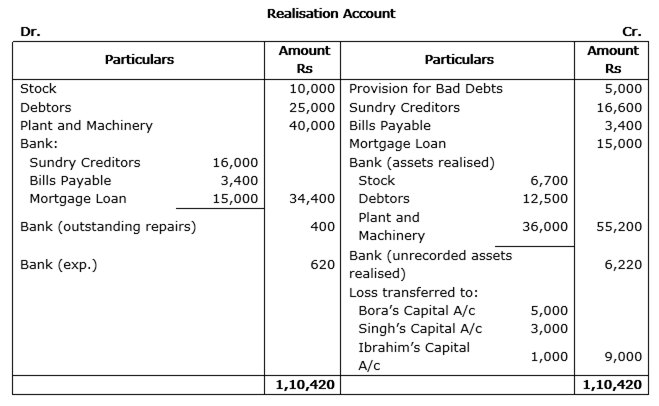

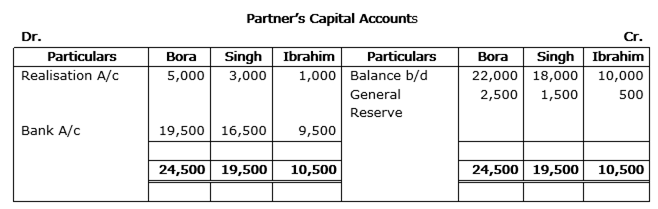

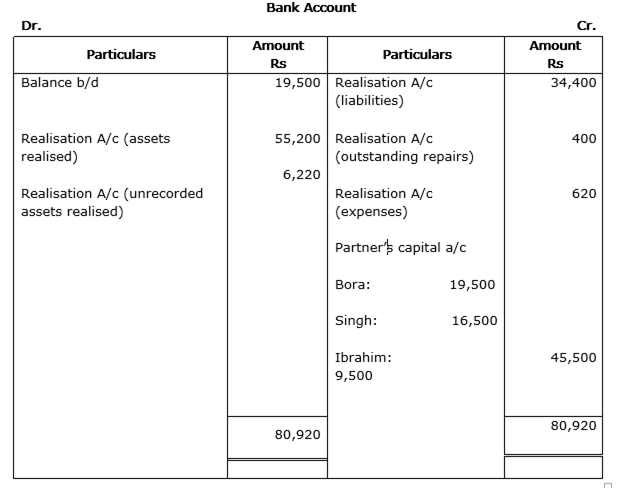

Bora, Singh and Ibrahim were partners in a firm sharing profits in the ratio of 5: 3: 1. On 2-3-2015 their firm was dissolved. The assets were realized and the liabilities were paid off. Given below are the Realisation Account, Partners' Capital Account and Bank Account of the firm. The accountant of the firm left a few amounts unposted in these accounts. You are required to complete these accounts by posting the correct amounts.

Pass the necessary Journal entries for the following transactions on the dissolution of the firm of P and Q after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account.

(i) Bank Loan Rs. 12,000 was paid.

(ii) Stock worth Rs. 16,000 was taken over by partner Q.

(iii) Partner P paid a creditor Rs. 4,000.

(iv) An asset not appearing in the books of accounts realised Rs. 1,200.

(v) Expenses of realisation Rs. 2,000 were paid by partner Q.

(vi) Profit on realisation Rs. 36,000 was distributed between P and Q in 5:4 ratio.

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

Shanti and Satya were partners in a firm sharing profits in the ratio of 4:1. On 31st March, 2013 their Balance Sheet was as follows:

On the above date the firm was dissolved:

(1) Shanti took over 40% of the stock at 10% less than its book value and the remaining stock was sold for Rs 40,000. Furniture realized Rs 80,000.

(2) An unrecorded investment was sold for Rs 20,000. Machinery was sold at a loss of Rs 60,000.

(3) Debtors realized Rs 55,000.

(4) There was an outstanding bill for repairs for which Rs 19,000 were paid. Prepare Realisation Account.

Prachi, Ritika and Ishita were partners in a firm sharing profits and losses in the ratio of 5:3:2. In spite of repeated reminders by the authorities, they kept dumping hazardous material into a nearby river. The court ordered for the dissolution of their partnership firm on 31st March 2012. Prachi was deputed to realise the assets and pay the liabilities. She was paid Rs 1,000 as commission for her services. The financial position of the firm was as follows:

Following was agreed upon:

Prachi took over investments for Rs 12,500. Stock and furniture realized Rs 41,500. There was old furniture which has been written off completely from the books. Ritika agreed to take away the same at the price of Rs 3,000. Compensation paid to the employees amounted to Rs 8,000. This liability was not provided in the above Balance Sheet. Realization expenses amounted to Rs 1,000. Prepare Realisation Account, Partner’s Capital Accounts and Cash A/c to close the books of the firm.

Also identify the value being conveyed in the question.