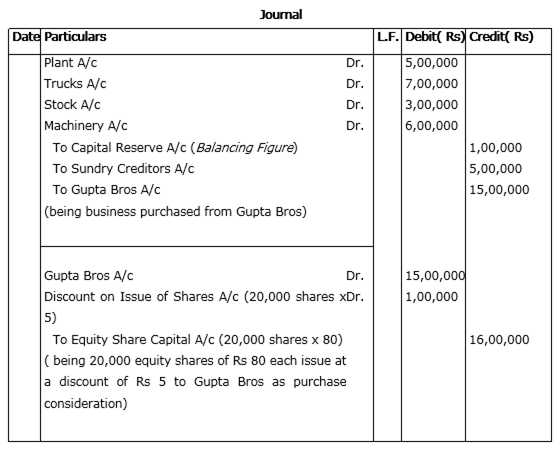

Madhav Ltd. issued fully paid equity shares of Rs. 80 each at a discount of Rs. 5 per share for the purchase of a running business from Gupta Bros. for a sum of Rs. 15,00,000.

The assets and liabilities consisted of the following:

Plant Rs. 5,00,000; Trucks Rs. 7,00,000; Stock Rs. 3,00,000; Machinery Rs. 6,00,000 and Sundry Creditors Rs. 5,00,000.

You are required to pass necessary journal entries for the above transactions in the books of Madhav Ltd.

Working Note:

Calculation of Number of Equity Shares Issued:

Purchase consideration = 15,00,000

Number of equity shares to be issued = 15,00,000/(80-5)

=15,00,000/75 = 20,000 equity shares

What is meant by Securities Premium?

XYZ Ltd. invited applications for 40,000 equity shares of Rs 100 each at a discount of 6%. The amount was payable as follows:

On Application and Allotment Rs 90 per share. On First and Final call the balance amount. Application for 60,000 shares were received. Applications for 10,000 shares were rejected and shares were allotted on pro-rata basis to remaining applicants. Excess application money received on application and allotment was adjusted towards sums due on first and final call. The calls were made. A shareholder, who applied for 50 share, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were re-issued at Rs 97 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of XYZ Ltd.

What rate of interest the company pays on calls - in advance if, it has not prepared its own Articles of Association?

AB Ltd. invited applications for issuing 75,000 equity shares of Rs 100 each at a premium of Rs 30 per share. The amount way payable as follows:

On Application and Allotment Rs 85 per share (including premium)On First and Final call the balance Amount Applications for 1,27,500 shares were received. Applications for 27,500 shares were rejected and share were allotted on pro-rata basis to the remaining applicants. Excess money received on application and allotment was adjusted towards sums due to first and final call. The calls were made. A shareholder, who applied for 1,000 shares, failed to pay the first and final call money. His shares were forfeited. All the forfeited shares were reissued at Rs 150 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of AB Ltd.