Explain the two components (revenue budget and capital budget) of government budget.

Components of the budget. The budget is divided into two parts — (i) Revenue Budget, and (ii) Capital Budget.

(i) The Revenue Budget comprises current revenue receipts and current expenditure met from such revenues. The revenue receipts include both tax revenue (like income tax, excise duty) and non-tax revenue (like interest receipts, profits). (ii) Capital Budget consists of capital receipts (like borrowing, disinvestment) and capital expenditure (creation of assests, investment) of the government. Capital receipts are receipts of the government which create liabilities or reduce assets. Capital expenditure is the expenditure of the government which either reduces liability or creates an asset. Thus, capital budget is an account of assets and liabilities of the government which takes into consideration changes in capital.

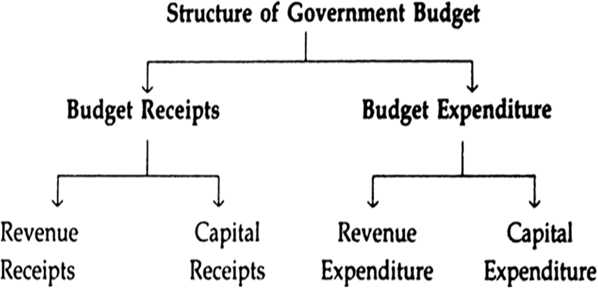

The structure (or components) of a government budget broadly consists of two parts — Budget Receipts and Budget Expenditure as shown in the following chart. Let us see their classification.