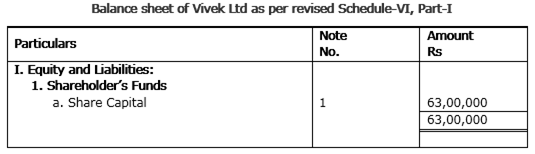

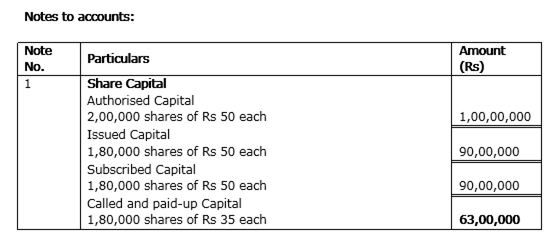

On 1st April, 2012, Vivek Ltd. Was formed with an authorized capital of Rs 1,00,00,000 divided into 2,00,000 equity shares of Rs 50 each. The company issued prospectus inviting applications for 1,80,000 shares. The issue price was payable as under:

On Application: Rs 15

On Allotment : Rs 20

On Call : Balance amount

The issue was fully subscribed and the company allotted shares to all the applicants. The company did not make the call during the year.

Show the following:

(a) Share capital in the Balance Sheet of the company as per revised Schedule-VI, Part-I of the Companies Act, 1956.

(b) Also prepare 'Notes to Accounts' for the same.

Give any one purpose for which the amount received as 'Securities Premium' may be utilised.

The amount received as securities premium can be utilised to write-off preliminary expenses of the company and to write-off the commission paid, or discount allowed on any of the shares or debentures of the company.

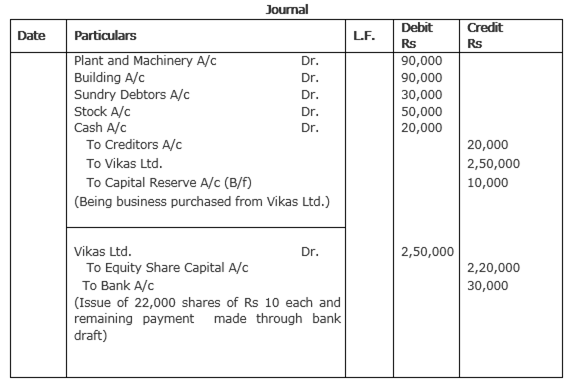

Pass necessary journal entries for the following transactions in the books of Rajan Ltd.

Rajan Ltd. purchased a running business from Vikas Ltd. for a sum of Rs 2,50,000 payable as Rs 2,20,000 in fully paid equity shares of Rs 10 each and balance by a bank draft. The assets and liabilities consisted of the following:

Plant & Machinery Rs 90,000; Building Rs 90,000; Sundry Debtors Rs 30,000; Stock Rs 50,000; Cash Rs 20,000; Sundry Creditors Rs 20,000.

What is the maximum amount of discount at which forfeited shares can be re-issued?

Forfeited shares can be reissued as fully paid at a par, premium or discount. In this, it may be noted that the amount of discount allowed cannot exceed the amount that had been received on forfeited shares at the time of initial issue.

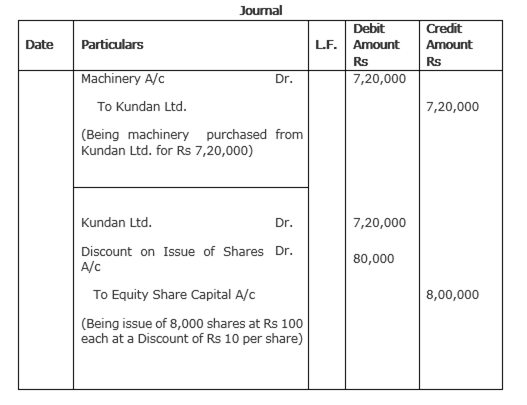

Pass necessary journal entries for the following transactions in the books of Rajan Ltd.

Rajan Ltd. purchased machinery of Rs 7,20,000 from Kundan Ltd. The payment was made to Kundan Ltd. by issue of equity shares of Rs 100 each at 10% discount.