Short Answer Type

Short Answer TypeWhere will sale of machinery to abroad be recorded in the Balance of Payments Accounts? Give reasons.

Explain the 'bank of issue' function of the central bank.

Or

Explain 'Government's Bank' function of central bank.

Government of India has recently launched 'Jan-Dhan Yojna' aimed at every household in the country to have at least one bank account. Explain how deposits made under the plan are going to affect national income of the country.

An economy is in equilibrium. Calculate national income from the following:

Autonomous consumption (C) = 100

Marginal propensity to save (S) = 0.2

Investment expenditure (I) = 200

Long Answer Type

Long Answer TypeA consumer consumes only two goods X and Y both priced at Rs. 3 per unit. If the consumer chooses a combination of these two goods with Marginal Rate of Substitution equal to 3, is the consumer in equilibrium? Give reasons. What will a rational consumer do in this situation? Explain.

Or

A consumer consumes only two goods X and Y whose prices are Rs. 4 and Rs. 5 per unit respectively. If the consumer chooses a combination of the two goods with marginal utility of X equal to 5 and that of Y equal to 4, is the consumer in equilibrium? Give reason. What will a rational consumer do in this situation? Use utility analysis.

Giving reason, explain how the following should be treated in estimation of national income:

(i) Expenditure by a firm on payment of fees to a chartered accountant

(ii) Payment of corporate tax by a firm

(iii) Purchase of refrigerator by a firm for own use

Explain the concept of Inflationary Gap. Explain the role of Repo Rate in reducing this gap.

OR

Explain the concept of Deflationary Gap and the role of 'Open Market Operations' in reducing this gap.

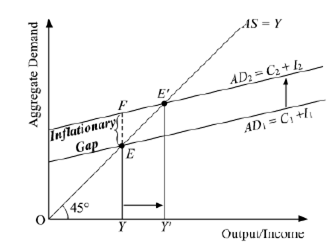

Inflationary gap is also referred to as excess demand. When aggregate demand is greater than aggregate supply, at full employment level in the economy, it is referred to as inflationary gap or excess demand. This situation actually results in an increase of prices, that is inflation.

Graphically, it is represented by the vertical distance between the actual level of aggregate demand (ADE) and the full employment level of output (ADF).

In the figure, EY denotes the aggregate demand at the full employment level of output and FY denotes the actual aggregate demand. The vertical distance between these two represents inflationary gap. That is,

FY – EY = FE (Inflationary Gap)

In the figure, AD1 and AS represent the aggregate demand curve and aggregate supply

curve respectively. The economy is at full employment equilibrium at point “E”, where AD1 intersects AS curve. At this equilibrium point, OY represents full employment level and EY is aggregate demand at the full employment level of output.

Suppose that the actual aggregate demand for output is FY, which is higher than EY. This implies that actual aggregate output demanded by the economy FY is more than the potential (full employment) aggregate output EY. Thus, the economy is facing surplus demand. This situation is termed as excess demand. As a result of the excess demand, inflationary gap arises. The inflationary gap is measured by the vertical distance between the actual aggregate demand for output and the potential (or full employment level) aggregate demand. In other words, the distance between FY and EY, i.e. FE represents the inflationary gap.

Repo rate refers to the rate at which the central bank lends to the commercial bank. In case of inflationary gap, the central bank would increase repo rate. An increase in the repo rate increases the cost of borrowings for the commercial banks. This discourages the demand for loans and borrowings. Thereby, the consumption expenditure falls, and hence aggregate demand falls.

Or

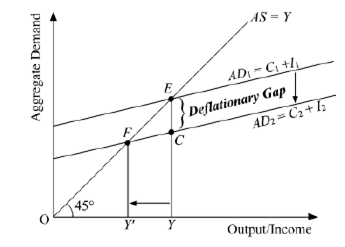

Deflationary gap is otherwise called as deficit demand. It is a situation where aggregate demand is less than aggregate supply at the level of full employment. Graphically, it is represented by the vertical distance between the aggregate demand at the full employment level of output (ADF) and the actual level of aggregate demand (ADE). In the figure below, EY denotes the aggregate demand at full employment level of output and CY denotes the actual aggregate demand. The vertical distance between these two represents deflationary gap.

EY – CY = EC (Deflationary Gap)

In the figure, AD1 and AS represent the aggregate demand curve and aggregate supply curve. The economy is at full employment equilibrium at point “E”, where AD1 intersects at AS curve. At this equilibrium point, OY represents the full employment level of output and EY is the aggregate demand at the full employment level of output.

Let us suppose that the actual aggregate demand for output is only CY, which is lower than EY. This implies that actual aggregate output demanded by the economy CY falls short of the potential (full-employment) aggregate output EY. Thus, the economy is facing a deficiency in demand. This situation is termed as deficit demand. As a result of the deficit demand, deflationary gap arises. The deflationary gap is measured by the vertical distance between the potential (or full employment level) aggregate demand and the actual aggregate demand for output. In other words, the distance between EY and CY,

i.e. EC represents the deflationary gap.

To correct deflationary gap, the central bank purchases the securities in the market through Open market operations (OMO). It refers to the buying and selling of government securities in the open market in order to expand or contract the amount of money in the banking system. Through OMO, the flow of money is increased and subsequently enhancing the purchasing power of the people. The higher purchasing power increases the aggregate demand.

Explain the role the government can play through the budget in influencing allocation of resources.

Calculate National Income and Personal Disposable Income:

| (Rs.crores) | ||

| (i) | Personal tax | 80 |

| (ii) | Private final consumption expenditure | 600 |

| (iii) | Undistributed profits | 30 |

| (iv) | Private income | 650 |

| (v) | Government final consumption expenditure | 100 |

| (vi) | Corporate tax | 50 |

| (vii) | Net domestic fixed capital formation | 70 |

| (viii) | Net indirect tax | 60 |

| (ix) | Depreciation | 14 |

| (x) | Change in stocks | (-) 10 |

| (xi) | Net imports | 20 |

| (xii) | Net factor income to abroad | 10 |