What are the alternative definitions of money supply in India?

or

Describe alternative measures of money supply as used by RBI in India.

Measures of money supply (money stock). In India there are four concepts of money supply. Reserve Bank of India uses four alternative measures of money supply called as M1, M2, M3, and M4. Each measure is briefly explained below. Among these measures, M1 is the most commonly used measure of money supply because its components are regarded as most liquid assets.

(i) M1 = C + DD + OD. Here C denotes currency (paper money and coins) held by public, DD stands for demand deposits in banks (inter-bank deposits are not included) and OD stands for other deposits with RBI. Demand deposits are deposits which can be withdrawn at any time on demand by account holders. Current account deposits are included in demand deposits. But savings account deposits are not included in DD because certain conditions are imposed on amount of withdrawal and number of withdrawals. OD stands for other deposits with the RBI which includes demand deposits of Public Financial Institutions (like Industrial Finance Corporation), demand deposits of foreign central banks and international financial institutions (like IMF).

(ii) M2 = M1 (detailed above) + Savings deposits with Post Office Saving Banks. (This is a broader concept of money supply as compared to M1).

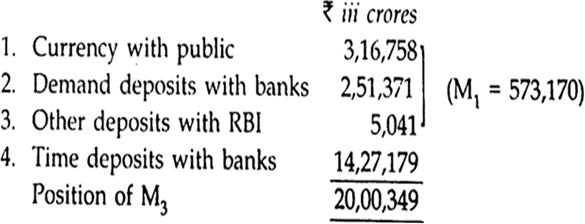

(iii) M3 = M1 + Net Time-deposits with Commercial Banks (Data of 2003–2004 is shown below). (This is also a broader concept of money supply as compared to M1).

(iv) M4 = M3 + Total deposits with Post Office Saving Organisation (excluding NSC).

(This is still broader – broader than even M3).

In fact, a great deal of debate is still going on as to what constitutes money supply. Savings deposits of post offices are not a part of money supply because they do not serve as medium of exchange due to lack of cheque facility. Similarly, fixed deposits in commercial banks is not counted as money. M1 and M2 are known as narrow money whereas M3 and M4 are known as broad money. In practice, M3 is widely used as measure of money supply which is also called aggregate monetary resources of the society. All the above four measures represent different degrees of liquidity, with M1 being the most liquid and M4being the least liquid of all. It may be noted that liquidity means ability to convert an asset into money quickly and without loss of value. According to government of India ‘Economic Survey 2004’, the position of M3 on March 31, 2004 was as under.

Functions of Commercial Banks.

The two most distinctive functions of a commercial bank are borrowing and lending, i.e., acceptance of deposits and lending of money to projects to earn interest. In short, banks borrow to lend. The rate of interest offered by the banks to depositors is called the borrowing rate while the rate at which banks lend out is called lending rate. The difference between the two rates is called ‘spread’ which is profit appropriated by the banks. Mind all financial institutions are not commercial bank as only those which perform dual functions of (i) accepting deposits and (ii) giving loans are termed as commercial banks. Functions of commercial banks are as under :

1. It accepts deposits. A commercial bank accepts deposits in the form of current, saving and fixed deposits. It collects the surplus balance of the individuals and firms and finances the temporary needs of commercial transactions. The first task is, therefore, the collecting of the savings of the public. This the bank does by accepting deposits from its customers. Deposits are lifeline of banks. Deposits are of 3 types as under.

(i) Current account deposits. Such deposits are payable on demand and are therefore, called demand deposits. These can be withdrawn by the depositors any number of times depending upon the balance in the account. The bank does not pay any interest on these deposits but provides cheque facilities. These accounts are generally maintained by businessmen and industrialists who receive and make business payments of large amounts through cheques.

(ii) Fixed deposits (Time deposits). Fixed deposits have a fixed period to maturity and are referred to as time deposits. These are deposits for a fixed term, i.e., period of time ranging from a few days to a few years. These are neither payable on demand nor they enjoy cheque facilities. They can be withdrawn only after the maturity of the specified fixed period. They carry higher rate of interest. They are not treated as a part of money supply. Recurring deposit in which a regular deposit of an agreed sum is made is also a variant of fixed deposits.

(iii) Saving account deposits. These are deposits whose main objective is to save. They combine the features of both current account and fixed deposits. They are payable on demand and also withdrawable by cheque. But bank gives this facility with some restrictions, e.g., a bank may allow five or seven cheques in a month. Interest paid on saving account deposits is lesser than that of fixed deposit.

Difference between demand deposits and time (term) deposits.

Two traditional forms of deposits are demand deposit and term (time) deposit. (i) Deposits which are payable by banks on demand from depositors are called demand deposits, e.g., Current A/c deposits are called demand deposits which are payable on demand either through cheque or otherwise. Term deposits are called time deposit because they are payable only after the expiry of the specified period. (ii) Demand deposits do not carry interest whereas time deposits carry a fixed rate of interest. (iii) Demand deposits are highly liquid whereas time deposits are less liquid. (iv) Demand deposits are chequable deposits whereas time deposits are not. A chequable deposit is any deposit account on which a cheque can be written.

2. It gives loans and advances. The second major function of a commercial bank is to give loans and advances particularly to businessmen and entrepreneurs and thereby earn interest. This is, in fact, the main source of income of the bank. A bank keeps a certain portion of the deposits with itself as reserve and gives (lends) the balance to the borrowers as loans and advances in the following forms.

(i) Cash Credit. An eligible borrower is first sanctioned a credit limit and within that limit he is allowed to withdraw a certain amount on a given security. The withdrawing power depends upon the borrower's current assets, the stock statement of which is submitted by him to the bank as the basis of security. Interest is charged by the bank on the drawn or utilised portion of credit (loan).

(ii) Demand Loans. A loan which can be recalled on demand is called demand loan. There is no stated maturity. The entire loan amount is paid in lump sum by crediting it to the loan account of the borrower. Those like security brokers whose credit needs fluctuate generally take such loans on personal security and financial assets.

(iii) Short-term Loans. Short-term loans are given against some security as personal loans to finance working capital or as priority sector advances. The entire amount is repaid either in one instalment or in a number of instalments over the period of loan.

Investment. Commercial banks invest their surplus funds in three types of securities (i) Government securities, (ii) Other approved securities, and (iii) Other securities. Banks earn interest on these securities.

Other functions : Apart from the above-mentioned two primary (major) functions, other functions performed by commercial banks are as follows:

3. Overdraft facility. An overdraft is an advance given by allowing a customer keeping current account to overdraw his current account up to an agreed limit. It is a facility to a depositor for overdrawing the amount than the balance amount in his account. In other words, depositors of current account make arrangement with the banks that in case a cheque has been drawn by them which is not covered by the deposit, then the bank should grant overdraft and honour the cheque. The security for overdraft is generally financial assets like shares, debentures, life insurance policies of the account holder.

Difference between overdraft facility and loan. (i) Overdraft is made without security in current account but loans are given against security. (ii) In case of loan, the borrower has to pay interests on full amount sanctioned but in case of overdraft, borrower is given the facility of borrowing only as much as he requires. (iii) Whereas the borrower of loan pays interest on amount outstanding against him but customer of overdraft pays interest on the daily balance.

4. Discounting bills of exchange or Hundis. A Bill of exchange represents a promise to pay a fixed amount of money at a specified point of time in future. It can also be encashed earlier through the discounting process of a commercial bank. In other words, a bill of exchange is a document acknowledging an amount of money owed in consideration of goods received. It is a paper asset signed by debtor and the creditor for a fixed amount payable on a fixed date. It works like this. Suppose A buys goods from B, he may not pay B immediately but instead give B a bill of exchange stating the amount of money owed and the time when A will settle the debt. Suppose B wants the money immediately, he will present the bill of exchange (Hundi) to the bank for discounting. The bank will deduct the commission and pay to B the present value of the bill. When the bill matures after specified period, the bank will get payment from A.

5. Agency functions of the Bank. The bank acts as an agent of its customers and gets commission for performing agency functions as under.

(i) Transfer of funds. It provides facility for cheap and easy remittance of funds from place to place through demand drafts, mail transfers, telegraphic transfers, etc.

(ii) Collection of funds. It collects funds through cheques, bills, hundis and demand drafts on behalf of its customers.

(iii) Payments of various items. It makes payment of taxes, insurance premium, bills, etc. as per directions of its customers.

(iv) Purchase and sale of shares and securities. It buys, sells and keeps in safe custody securities and shares on behalf of its customers.

(v) Collection of dividends, interest on shares and debentures are made on behalf of its customers.

(vi) Acts as Trustee and Executor of property of its customers on advice of its customers.

(vii) Letters of References. It gives information about, economic position of its customers to traders and provides the similar information about other traders to its customers.

6. Financing of Foreign Trade. Commercial banks finance the foreign trade of the country by accepting or collecting bills of exchange drawn by customers.

7. Performing General Utility Services. The bank provides many general utility services. Some of which are as under:

(i) Issuance of traveller's cheques and gift cheques.

(ii) Locker facility. The customers can keep their ornaments and important documents in lockers for safe custody.

(iii) Underwriting securities issued by government, public or private bodies.

(iv) Purchase and sale of foreign exchange (Currency).

(v) Letters of credit are issued by the banks to their customers certifying their credit worthiness.

Why is speculative demand for money inversely related to the rate of interest?

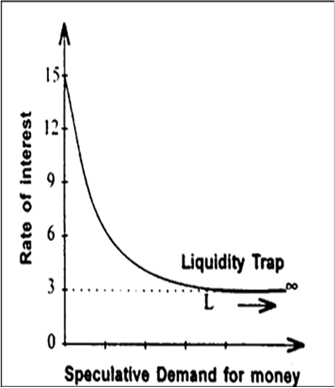

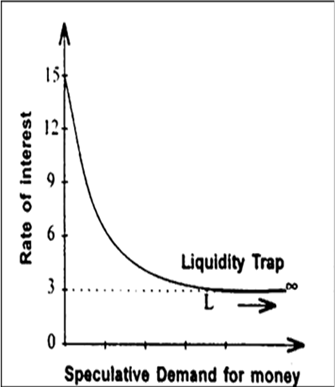

Relationship between speculative demand for money and rate of interest. Speculative demand for money is inversely related to rate of interest, i.e., higher the rate of interest, smaller will be speculative demand for money and vice versa as proved above. Therefore, curve of speculative demand for money is downward sloping to right as shown in the following Fig. (a). There are two situations:

(i) If market rate of interest is very high and everyone expects it to fail in future (i.e., rise in price of bond) thereby anticipating capital gain from bond-holding, people will convert their money into bonds. Thus speculative demand for money is low. In Fig. (a) at very high rate of interest, say 15%, people convert their entire money holding into bonds indicating speculative demand for money to be zero. (Remember, rise in bond price means gain to the bond-holder —similar to gain of a property dealer when price of property rises. Such a gain occurring from rising price of bond is called Capital Gain.).

(ii) On the contrary, if rate of interest is low and people expect it to rise in future (i.e., fall in price of bond) anticipating capital loss from bond-holding, people convert their bonds into money in order to avoid future capital loss. They hold up money balance thinking that income from non-monetary assets like bond will be low and so the cost of money holding will also be low. Thus speculative demand for money becomes very high so much so that when rate of interest declines to minimum, say 3% as shown in Fig.(a), speculative demand for money becomes infinite (perfectly elastic). This pushes the economy into liquidity trap and the speculative demand curve becomes flat as shown in (a).

Total demand for money (Md) consists of transaction demand (including precautionary demand) for money ![]() as a function of income and speculative (or asset) demand for money

as a function of income and speculative (or asset) demand for money ![]() as a function of rate of interest. Symbolically:

as a function of rate of interest. Symbolically:![]()

What is money multiplier? How will you determine its value? What ratios play an important role in the determination of the value of the money multiplier?

Money Multiplier. Money multiplier (m) is the ratio of total money supply (M) to the stock of high powered money (H) in the economy.

Symbolically:![]()

where m represents money multiplier, M total money supply and H represents stock of high powered money.

Clearly value of multiplier m is greater than 1 (M > 1) because increment in M exceeds H initially injected by RBI. Money supply in the economy is determined by the size of multiplier (m) and the amount of high powered money (H).

Suppose the value of m = 1.5 and that of H = र 1000 crores. Then total money supply (H) will be 1000 x 1.5 = र 1500 crores. In short, this is the process of money creation.

Since,

M /H = (1 + cdr) / (cdr + rdr)

Hence, the current deposit ratio (cdr) and reserve deposit ratio (rdr) play an important role in the determination of money multiplier.