Commercial banks create credit in the form of demand deposits. Remember ‘demand deposits’ and ‘currency with public’ are two basic components of money supply. Broadly, when a bank receives cash deposits from the public, it keeps a fraction of deposit as cash reserve and uses the remaining amount for giving loans to earn interest income. This fraction is called Legal Reserve Ratio (LRR) (which has two components — CRR and SLR). LRR is the minimum ratio (fraction) of demand deposits fixed by Central Bank which is legally compulsory for every commercial bank to keep as cash reserves. In the process of lending money, banks are able to create credit through secondary deposits many times more than the initial deposit (primary deposit). How? (Primary deposits are cash deposits whereas secondary deposits arise due to loans given by the banks to people.)

Process of money (credit) creation. Suppose a man, say x, deposits र 2000, with a bank and the LRR is 10% which means the bank keeps only the minimum required र 200 as cash reserve. The bank can use the remaining amount र 1800 (= 2000 - 200) for giving loan to someone. (Mind, loan is never given in cash but it is reflected as demand deposit in favour of borrower.) The bank lends र 1800 to, say y, who is actually not given loan but only (demand deposit) account is opened in his name and the amount is credited to his account. This is the first round of credit creation in the form of secondary deposit (र 1800) which equals 90% of primary (initial) deposit. Again 10% of Y‘s deposit (i.e., र 180) is kept by the bank as cash reserve and the balance र 1620 (= 1800 – 180) is advanced to, say z. The bank gets new demand deposit. This is second round of credit creation which is 90% of first round of increase of र 1800. The third round of credit creation will be 90% of second round of र 1620. This is not the end of the story. The process of credit creation goes on continuously till derivative deposit (secondary deposit) becomes zero. In the end volume of total credit created in this way becomes multiple of initial (primary) deposit. The quantitative outcome is called money multiplier. If the bank succeeds in creating total credit of say, र 18,000, it means bank has created 9 times of primary (initial) deposit of र 2000. This is what is meant by credit creation. In short money (or credit) creation by commercial banks is determined by (i) amount of initial (primary) deposits, and (ii) LRR. The multiple is called credit creation or money multiplier. Symbolically:

Credit creation = ![]()

Money multiplier. It means the multiple by which total deposit increases due to initial (primary) deposit. Money creation (or credit creation) is the inverse of LRR.

If LRR = 10%, i.e., 0.1, then money multiplier ![]()

Smaller the LRR, larger would be the size of money multiplier.

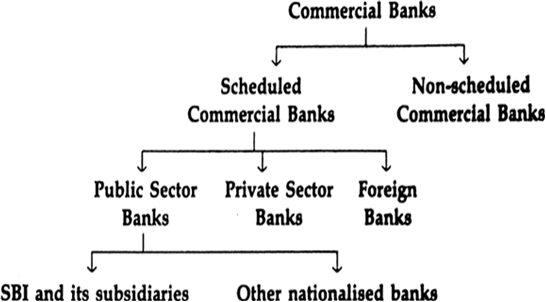

The following tree diagram depicts broad classification of commercial banks in India.