Long Answer Type

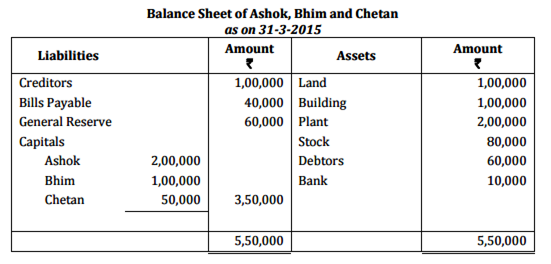

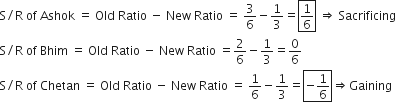

Long Answer TypeAshok, Bhim and Chetan were partners in a firm sharing profits in the ratio of 3:2:1. Their Balance Sheet as on 31-3-2015 was as follows:

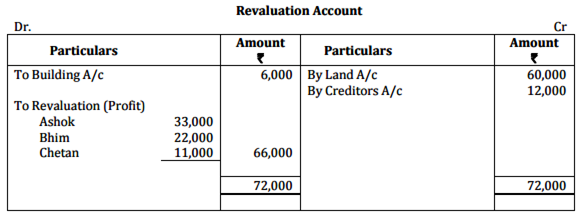

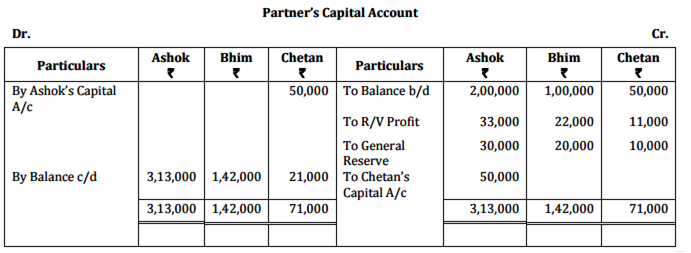

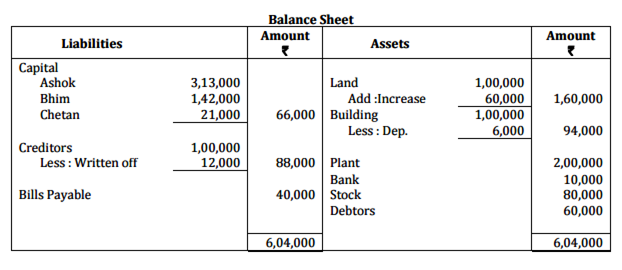

Ashok, Bhim and Chetan decided to share the future profits equally,В w.e.f. April 1, 2015. For this it was agreed that:

(i) Goodwill of the firm be valued at 3,00,000.

(ii) Land be revalued at 1,60,000 and building be depreciated by 6%.

(iii) Creditors of 12,000 were not likely to be claimed and hence be written off.

Prepare Revaluation Account Partner's Capital Accounts and Balance Sheet of the reconstituted firm

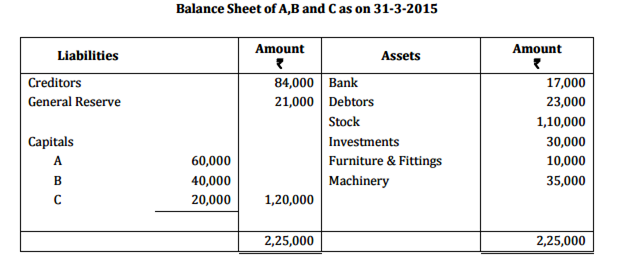

A, B and C were partners in a firm sharing profit in the ratio of 3:2:1. On 31-3-2015 their Balance sheet was as follows:

On the above date D was admitted as aВ new partner and it was decided that

(i) The new profit sharing ratio between A, B, C and D will be 2:1:1:1.

(ii) Goodwill of the firm was valued at в‚№ 90,000 and D brought his share of goodwill premium in cash.

(iii) The Market value of investments was в‚№24,000.

(iv) Machinery will be reduced to в‚№29,000.

(v) A Creditor of в‚№ 3,000 was not likely to claim the amount and hence to be written off.

(vi) D will bring proportionate capital so as to give him 1/6th share in the profits of the firm. Prepare Revaluations Account, Partner’s Capital Accounts and Balance Sheet of the reconstitute firm

X, Y and Z were partners in a firm sharing profit’s in the firm of 5:3:2. On 31-3-2015 their Balance Sheet was as follows:

On the above date Y retired and X and Z agreed to continue the business on the following terms:

(1) Goodwill of the firm was valued at в‚№51,000

(2) There was a claim of 4,000 for Workmen’s Compensation.

(3) Provision for bad debts was to be reduced by 1,000.

(4) Y will be paid 8,200 in cash and the balance will be transferred in his loan account which will be paid in four equally yearly instalments together with interest @ 10% p.a.

(5) The new profit sharing ratio between X and Z will be 3:2 and their capitals will be in their new profit sharing ratio. The Capital adjustments will be done by opening current Accounts.

Prepare Revaluation Account. Partner’s Capital Accounts and the Balance Sheet of reconstituted firm

On 1-4-2013 JN Ltd had 10,000, 9% Debentures of 100 each outstanding.

(i) On 1-4-2014 the company purchased in the open market 2000 of its own debentures for 101 each and cancelled the same immediately.

(ii) On 1-4-2015 the company redeemed at par debentures of 4,00,000 by draw of a lot.

(iii) On 28-2-2016 the remaining debentures were purchased for immediate cancellation for 3,97,000.

Pass necessary journal entries for the above transactions in the books of the company ignoring debentures redemption reserve and interest on debentures.

KS Ltd invited application for issuing 1,60,000 equity shares of в‚№ 10 each at a premium of 6 per share. The amount was payable as follows;

On Application в‚№ 4 per share (including premium в‚№ 1 per share)

On Allotment в‚№ 6 per share (including premium в‚№3 per share)

On First and Final Call – Balance

Application for 3,20,000 shares were received. Applications for 80,000 share were rejected and application money refunded. Shares were allotted on pro-rata basis to the remaining applicants. Excess money received with application was adjusted towards sums due on allotment. Jain holding 800 shares failed to pay the allotment money his shares were forfeited immediately after allotment. Afterwards, the final call was made. Gupta who has applied for 1200 shares failed to pay the final call. These shares were forfeited. Out of the forfeited shares 1000 shares were re-issued at 8 per share fully paid up. The re-issued shares included all the forfeited shares of Jain Pass necessary journal entries for the above transactions in the books of KS Ltd

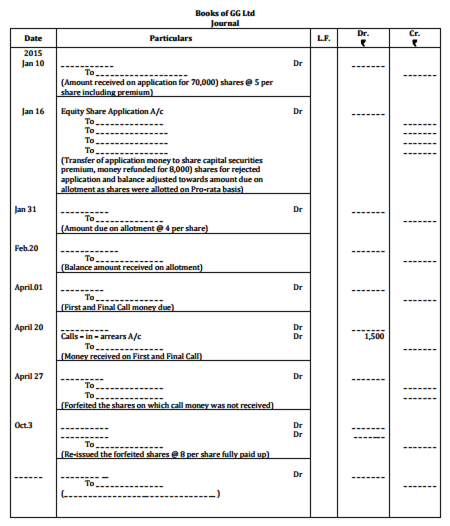

GG Ltd has issued 50,000 equity shares of 10 each at a premium of 2 per share payable with application money. The incomplete journal entries related to the issue are given below. You are required to complete these blanks.

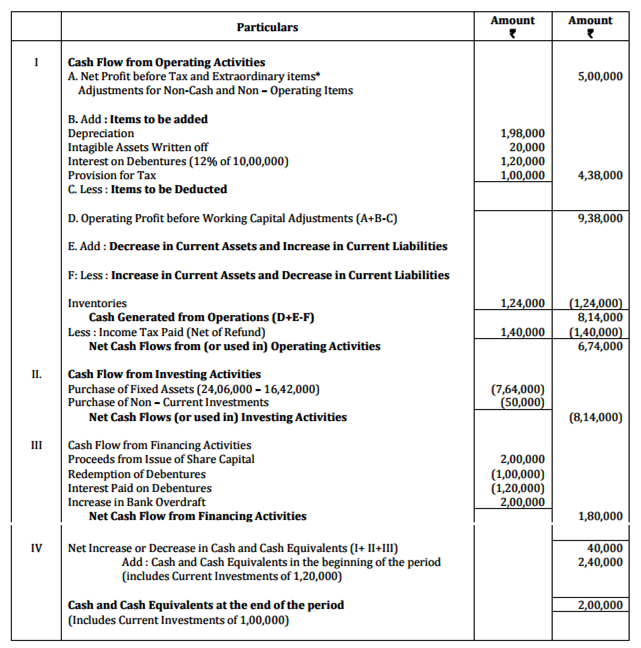

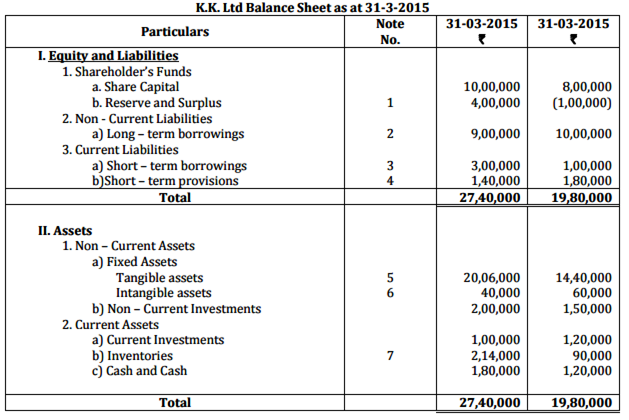

Following is the Balance Sheet of K K Ltd as at 31-3-2015:

Additional Information:

(i) 12% Debentures were redeemed on 31-3-2015

(ii) Tax 1,40,000 was paid during the year

Prepare Cash flow Statement