Short Answer Type

Short Answer TypeWhat is meant by 'Reconstitution of a Partnership Firm'?

In a partnership firm, any change in the existing agreement between the partners amounts to its reconstitution. It leads to the end of the existing agreement and a new agreement comes into being with a changed relationship among the members of the partnership firm.

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5, 1/10. Find the new ratio of remaining partners if Z retires.

Distinguish between 'Dissolution of Partnership' and Dissolution of Partnership Firm' on the basis of closure of books.

Why heirs of a retiring/deceased partner are entitled to a share of goodwill of the firm?

Saloni and Shrishti were partners in a firm sharing profits in the ratio of 7:3. Their capitals were Rs 2,00,000 and Rs 1,50,000 respectively. They admitted Aditi on 1st April, 2013 as a new partner for 1/6 share in future profits. Aditi brought Rs 1,00,000 as her capital. Calculate the value of goodwill of the firm and record necessary journal entries for the above transaction on Aditi's admission.

Satnam and Qureshi after doing their MBA decided to start a partnership firm to manufacture ISI marked electronic goods for economically weaker section of the society. Satnam also expressed his willingness to admit Juliee as partner without capital who is especially abled but a very creative and intelligent friend of him. Qureshi agreed to this. They formed a partnership on 1st April 2012 on the following terms:

(i) Satnam will contribute Rs 4,00,000 and Qureshi will contribute Rs 2,00,000 as capitals.

(ii) Satnam, Qureshi and Juliee will share profits in the ratio of 2:2:1.

(iii) Interest on capital will be allowed @ 6% p.a. Due to shortage of capital Satnam contributed Rs 50,000 on 30th September, 2012 and Qureshi contributed Rs 20,000 on 1st January, 2013 as additional capitals. The profit of the firm for the year ended 31st March, 2013 was Rs 3,37,800.

(a) Identify any two values which the firm wants to communicate to the society.

(b) Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2013.

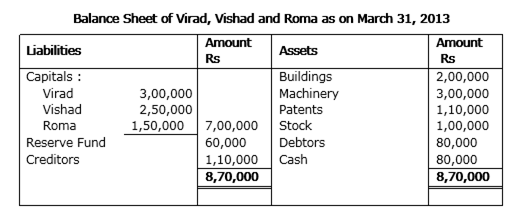

Virad, Vishad and Roma were partners in a firm sharing profits in the ratio of 5:3:2 respectively. On March 31, 2013, their Balance Sheet was as under:

Virad died on October 1, 2013. It was agreed between his executors and the remaining partner's that:

(a) Goodwill of the firm be valued at 2 1/2 years purchase of average profits for the last three years. The average profits were Rs 1,50,000.

(b) Interest on capital be provided at 10% p.a.

(c) Profit for the year 2013-14 be taken as having accrued at the same rate as that of the previous year which was Rs 1,50,000. Prepare Virad's Capital Account to be presented to his Executors as on October 1, 2013.

Give any one purpose for which the amount received as 'Securities Premium' may be utilised.