Short Answer Type

Short Answer TypeA consumer consumes only two goods X and Y. State and explain the conditions of consumer's equilibrium with the help of utility analysis.

Explain how the demand for a good is affected by the prices of its related goods. Give examples.

Define 'Market-supply'. What is the effect on the supply of a good when Government imposes a tax on the production of that good? Explain.

The total supply of every seller willing and able to sell a good. Market supply is found by combining the individual supplies of every firm or producer willing and able to sell a particular good. The market supply curve is found by horizontally adding all individual supply curves, that is, sum up the quantities supplied by all sellers at each and every price. Market supply operates according to the law of supply, as illustrated by an upward-sloping market supply curve. For higher prices the quantity supplied by all sellers in the market combined is greater than the quantity supplied for lower prices.

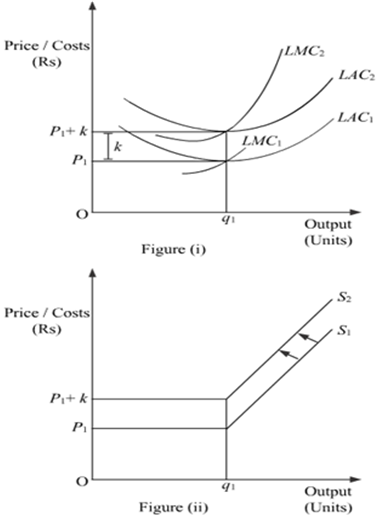

When the government imposes tax on the production of a good then that increases the cost of production. Consequently, the firm will supply lesser units of output. The diagrammatic presentation of the effect on the supply of a good when government imposes a tax on the production of that good is as follows.

In the diagram, LAC1 and LMC1 are the long run average cost curve and long run marginal cost curve respectively. In the lower panel we represent the supply curve which is the rising part of the LMC. Suppose,initially the firm faces price equal to OP1. Now, if the government imposes a unit tax of Rs ‘K’ per unit of output, then this will raise the cost of production as the firm need to pay an extra amount of Rs k on each unit of the output supplied. Consequently, the cost curves will shift leftwards (upwards) to LMC2 and LAC2. The magnitude of the shift in the cost curves is equal to Rs k. Now, as the supply curve is a rising part of LMC, so the supply curve in the figure (ii) will also shift leftward upwards from S1 to S2. That is, the firm will now supply lesser units of output due to imposition of tax

What is a supply schedule? What is the effect on the supply of a good when Government gives a subsidy on the production of that good? Explain.

Long Answer Type

Long Answer TypeWhat is meant by producer's equilibrium? Explain the conditions of producer's equilibrium through the 'total revenue and total cost' approach. Use diagram.

Market for a good is in equilibrium. There is an 'increase' in demand for this good. Explain the chain of effects of this change. Use diagram.

Short Answer Type

Short Answer Type